比特币创下历史新高

比特币突破价格历史新高这项成就的背后是多重因素的共同推动,包括全球监管环境的快速转向友好、美国释放稳定币法案草案以及总统公开支持加密立法等。

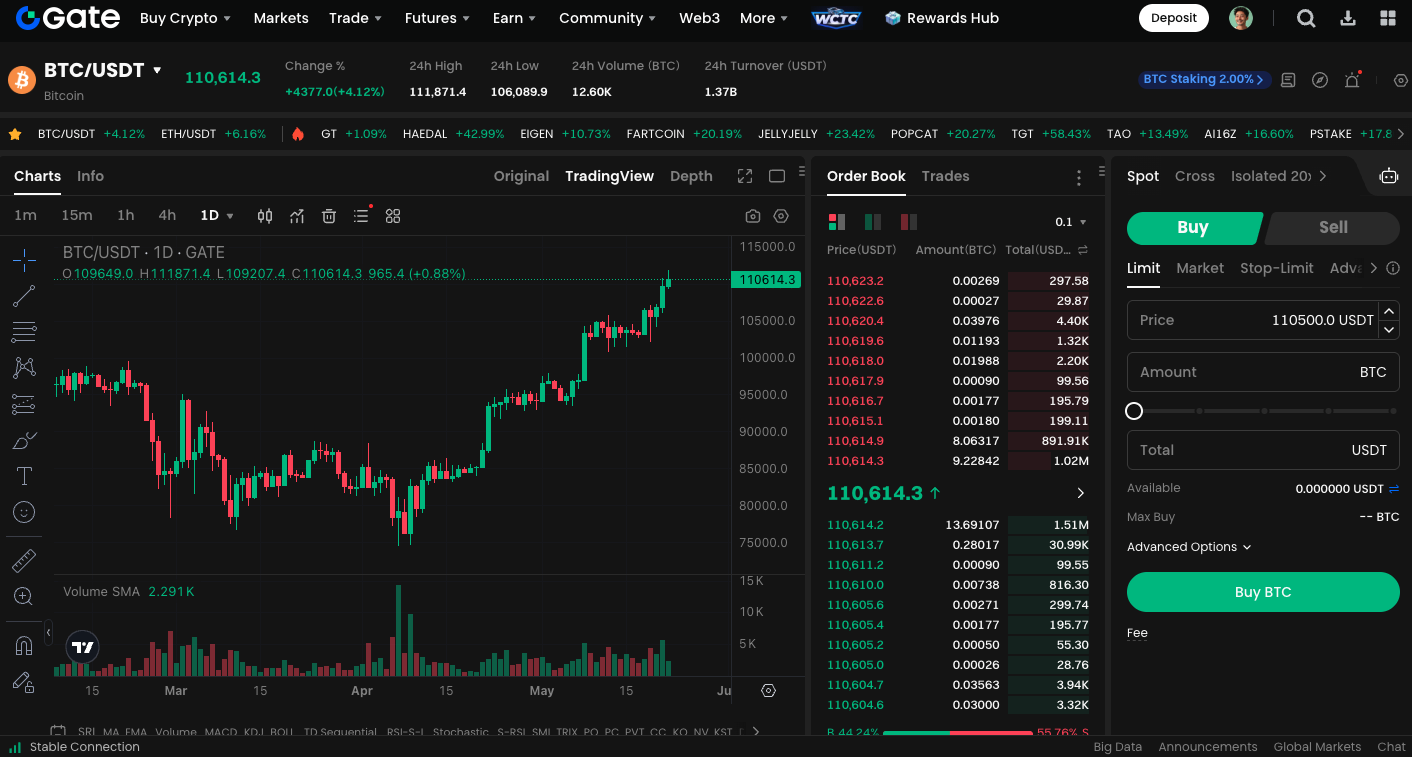

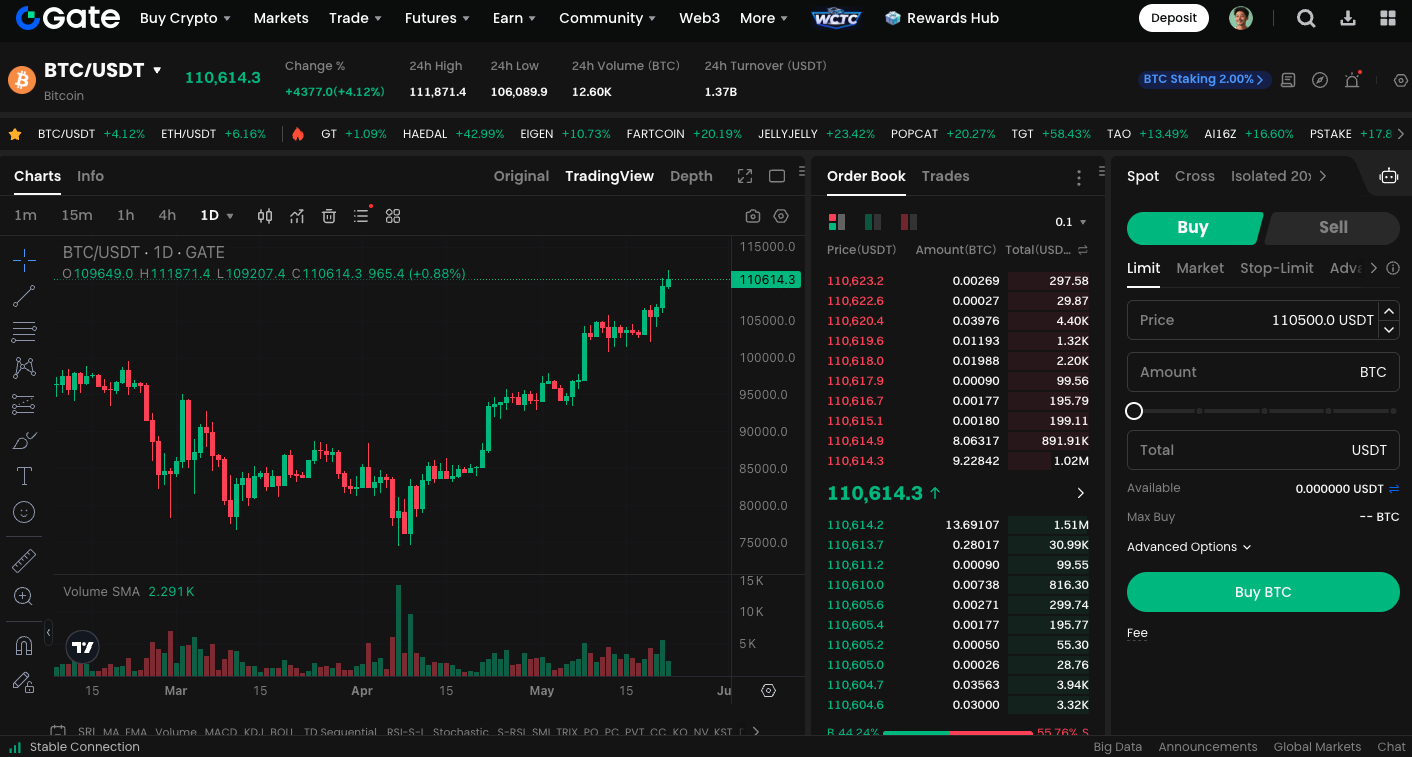

BTC 价格突破历史新高

2025 年 5 月 22 日,加密世界再度迎来历史性的一刻,比特币(BTC)在亚洲交易时段强势突破 11 万美元大关,刷新自创世以来的价格纪录,这场多头行情大概率是来自机构资金、政策趋势与全球经济局势共同推动。

(来源:TradingView, 2025.05.22)

BTC 跃升为全球第五大资产

BTC 11 万美元对过去的比特币老矿工而言,或许是个疯狂的梦,但今天这个数字确确实实地写进历史,根据市场数据显示,BTC 总市值已突破 2.19 兆美元,正式超越 Google、亚马逊,仅次于黄金与苹果、微软、辉达等科技巨头,成为全球资产排行榜的第五位。

(来源:8marketcap, 2025.05.22)

BTC 叙事的质变时刻

当前比特币创下历史新高的背后,是多重因素共振的结果,全球监管环境正快速转向友善,特别是美国释出稳定币法案草案与总统公开支持加密立法,让制度面更明确,为机构资金打开大门,与此同时,宏观经济形势出现结构性转变,美元疲软、地缘政治紧张、信用评级下调等事件,使更多人将比特币视为对抗传统金融体系风险的数位黄金。这一波上涨的叙事已彻底翻转,不再只是单纯炒币,而是建立在政策共识、制度转型与价值共鸣上的长期信仰。

即刻开始进行 BTC 现货交易:https://www.gate.com/trade/BTC_USDT

总结

比特币的历史从不缺高潮,但每一次创新高,都代表著一次更深层的社会对话,不仅是数字与价值的飞跃,更是一场去中心化理念、货币主权与自由金融的实践之路。

作者: Allen

* 投资有风险,入市须谨慎。本文不作为 Gate 提供的投资理财建议或其他任何类型的建议。

* 在未提及 Gate 的情况下,复制、传播或抄袭本文将违反《版权法》,Gate 有权追究其法律责任。

即刻开始交易

注册并交易即可获得

$100

和价值$5500

理财体验金奖励!