Previsão de Preço $BCH: Uma Análise Profunda do Futuro do Bitcoin Cash

Bitcoin Cash (BCH) é uma das principais altcoins que surgiram do legado do Bitcoin. Como uma criptomoeda com sua própria filosofia de escalonamento distinta e objetivos de eficiência de transação, o BCH gerou um interesse significativo entre investidores e negociantes.

A longo prazo, o futuro do BCH está entrelaçado com inovações tecnológicas e uma adoção mais ampla no mercado. Embora permaneçam incertezas e fatores externos como mudanças regulatórias possam perturbar até mesmo as melhores previsões, os investidores que monitoram continuamente os indicadores técnicos e as tendências fundamentais podem se posicionar melhor para o sucesso. Em última análise, as previsões de preço do BCH servem como um guia - uma ferramenta para ajudar a navegar pelo mundo volátil, mas emocionante, da negociação de criptomoedas.

Os investidores são encorajados a permanecer diligentes, diversificar suas carteiras e tomar decisões com base numa análise abrangente de dados técnicos e desenvolvimentos do mundo real. À medida que o Bitcoin Cash continua a evoluir, a sua trajetória de preços pode oferecer oportunidades de lucro significativas para aqueles que estão preparados para a sua volatilidade inerente.

Fonte da imagem: Website

Compreender Bitcoin Cash

Bitcoin Cash foi criado em agosto de 2017 como resultado de um hard fork do Bitcoin. Os defensores do BCH visionaram um sistema de dinheiro digital com taxas de transação mais baixas e tempos de confirmação mais rápidos - uma resposta aos desafios de escalabilidade que o Bitcoin tinha enfrentado. Com o tempo, o BCH evoluiu seu protocolo com tamanhos de bloco aumentados, throughput de transações aprimorado e atualizações de desenvolvimento contínuas. Apesar da volatilidade ocasional e da concorrência de outras criptomoedas, o BCH conseguiu permanecer uma das principais criptomoedas em termos de capitalização de mercado.

Principais características do BCH

- Escalabilidade: BCH aumentou o limite do tamanho do bloco (inicialmente 8MB e posteriormente expandido) para lidar com um maior número de transações por segundo. Isso reduziu a congestão da rede e diminuiu as taxas.

- Velocidade e custo da transação: Com confirmação de bloco mais rápida e taxas minimizadas, BCH é projetado para transações diárias entre pares.

- Descentralização: Tal como outras redes blockchain, o Bitcoin Cash é alimentado por uma rede descentralizada de mineiros que validam transações usando um mecanismo de consenso de prova de trabalho (PoW).

- Adoção no mercado: Embora a adoção do BCH por comerciantes e investidores continue a ser mista em comparação com o Bitcoin (BTC), suas características tecnológicas continuam a atrair interesse entre os usuários que valorizam a utilidade e a velocidade.

Fatores técnicos que impulsionam a previsão de preço do BCH

A previsão de preços para qualquer criptomoeda depende tanto da análise técnica quanto da análise fundamental. Quando se trata de BCH, vários indicadores técnicos são amplamente utilizados por analistas para prever movimentos de preços futuros:

Médias Móveis

As médias móveis suavizam os dados de preço para destacar tendências. Os analistas geralmente observam as médias móveis simples de 50 dias e 200 dias (SMAs) para identificar níveis de suporte e resistência:

- SMA de 50 dias: Os traders de curto prazo usam a SMA de 50 dias para avaliar o momentum. Uma SMA de 50 dias em alta pode sinalizar uma tendência de preço ascendente, enquanto uma em queda pode sugerir fraqueza.

- SMA de 200 dias: Para tendências de longo prazo, o SMA de 200 dias é crucial. O preço do Bitcoin Cash negociando acima do SMA de 200 dias é frequentemente visto como um sinal de alta, enquanto negociar abaixo dele pode indicar uma tendência de baixa de longo prazo.

Índice de Força Relativa (RSI)

O RSI mede o momentum numa escala de 0 a 100:

- Condições de sobrevenda: RSI acima de 70 implica que o BCH pode estar devido a uma correção.

- Condições de sobrevenda: RSI abaixo de 30 indica que o ativo pode estar subvalorizado. Tipicamente, um RSI na faixa neutra (30–70) sugere que o ativo está razoavelmente valorizado, mas divergência ou condições extremas podem sinalizar reversões iminentes.

MACD (Convergência e Divergência de Médias Móveis)

O indicador MACD ajuda os traders a identificar a direção da tendência e mudanças de momentum ao comparar EMAs de curto prazo e longo prazo. Quando a linha MACD cruza acima da linha de sinal, é considerado otimista; uma cruzamento na direção oposta é pessimista.

Níveis de Suporte e Resistência

Os níveis horizontais chave atuam como barreiras onde o preço do BCH tende a encontrar suporte (quando o preço está caindo) ou encontrar resistência (quando o preço está subindo). Para o BCH, os dados históricos mostram que certos intervalos de preço atuaram repetidamente como pisos ou tetos. Observar esses níveis ajuda a prever a probabilidade de reversões de preço.

Factores Fundamentais que Impactam BCH

A análise técnica fornece uma visão geral do sentimento do mercado, mas os fatores fundamentais também moldam as perspectivas de longo prazo do BCH:

Adoção de rede e volume de transações

O crescimento no número de comerciantes e utilizadores que aceitam BCH como pagamento é crucial. O aumento do volume de transações e de endereços ativos indicam uma maior utilização no mundo real, potencialmente aumentando a procura.

Desenvolvimento e Atualizações Tecnológicas

Melhorias em curso, como recursos de privacidade aprimorados, protocolos de tamanho de bloco otimizados e integrações com soluções de camada 2, podem tornar o BCH mais atraente. As atualizações bem-sucedidas podem aumentar a confiança dos investidores, resultando em aumentos de preço.

Sentimento de mercado e tendências macroeconómicas

As condições econômicas globais, desenvolvimentos regulatórios e tendências de mercado de criptomoedas influenciam fortemente o preço do BCH. Por exemplo, em períodos de alto risco ou volatilidade, os investidores podem se dirigir para criptomoedas mais estabelecidas ou "mais seguras", enquanto ciclos de mercado otimistas podem beneficiar altcoins como o BCH.

Atividade de Baleias e Interesse Institucional

Grandes investidores ou "baleias" que detêm quantidades significativas de BCH podem impactar o preço através de grandes negociações. O interesse institucional, especialmente se grandes empresas financeiras incorporarem BCH em suas carteiras de investimento, pode levar a entradas substanciais e apoiar o preço.

Tendências de Preço Históricas BCH

Observar o histórico de preços do BCH fornece contexto para seu potencial futuro:

- 2017: No seu início, o BCH tinha um preço semelhante ao do Bitcoin, mas rapidamente divergiu à medida que o mercado testava as suas alegações de escalabilidade.

- 2020: BCH experimentou volatilidade com períodos de altas significativas e quedas acentuadas, em meio a flutuações mais amplas do mercado cripto.

- 2021–2022: Os investidores testemunharam flutuações crescentes enquanto o BCH tentava se estabelecer em meio às pressões regulatórias e incertezas de mercado.

- 2023–Início de 2024: BCH experimentou consolidação, com intervalos de negociação relativamente estreitos, antes de catalisadores recentes (como atualizações de protocolo ou anúncios institucionais) despertarem novo interesse.

A história mostra que, apesar de períodos de estagnação, BCH tem o potencial de rápidos ressaltos. Estes ciclos são importantes para prever para onde o preço pode seguir a seguir.

Previsão de Preço do BCH para o Curto Prazo (2025)

Previsões de curto prazo para o preço do BCH em 2025 variam entre plataformas, mas geralmente sugerem movimentos significativos:

- Intervalo Esperado: Os analistas preveem que o BCH irá negociar entre $300 e $800 durante 2025. Algumas fontes até prevêem que, em condições otimistas, o BCH poderia se aproximar ou exceder a marca dos $1,000.

- Níveis de suporte chave: Um piso em torno de $300 é crucial. Se o BCH se mantiver acima deste nível e apresentar indicadores técnicos positivos, poderá ver um impulso ascendente.

- Catalisadores: As próximas atualizações tecnológicas ou o aumento do uso da rede em meados de 2025 poderão impulsionar os preços para o extremo superior do intervalo previsto.

Por exemplo, ferramentas técnicas como TradingView e CoinCodex mostram níveis de RSI e médias móveis em equilíbrio dinâmico. Isso indica um mercado equilibrado pronto para uma correção ascendente se os catalisadores se alinharem favoravelmente.

Previsão de Preço do BCH para o Médio Prazo (2026–2027)

Estendendo a vista ainda mais:

- Previsão de 2026: Os analistas esperam que o BCH experimente ganhos moderados em 2026, com um preço médio potencial na faixa de $700 a $900. Esta previsão é baseada em atualizações previstas na rede e um aumento gradual na adoção.

- Previsão de 2027: Mais cenários otimistas preveem que o BCH testará níveis significativos de resistência, possivelmente atingindo ou excedendo os $1,100. Num cenário em que o sentimento geral do mercado permanece positivo e a adoção institucional se expande, os investidores poderiam ver o valor do BCH ultrapassar máximos anteriores. No entanto, deve-se ter cautela dada a volatilidade inerente das altcoins.

Linhas de tendência técnica, combinadas com tendências mais amplas do mercado de criptomoedas, sugerem que 2026 pode servir como um período de consolidação, preparando o terreno para uma corrida de touros em 2027. Uma quebra bem-sucedida desses níveis serviria como um momento crucial para a trajetória de preço do BCH.

Previsão de Preço BCH a Longo Prazo (2030 e Além)

Olhando mais adiante, as previsões de preço de longo prazo do BCH dependem das tendências macroeconômicas e da capacidade do BCH de conquistar quota de mercado:

- Perspetivas para 2030: Alguns analistas a longo prazo projetam que o BCH possa oscilar entre $1.200 e $2.000 até 2030. Esta previsão otimista depende de o BCH manter a sua proposta de valor única, progresso tecnológico e aumento da adoção global. A ideia fundamental é que, à medida que as moedas digitais se tornam um meio de pagamento aceite em todo o mundo, o papel do BCH em transações rápidas e de baixo custo pode originar um crescimento substancial.

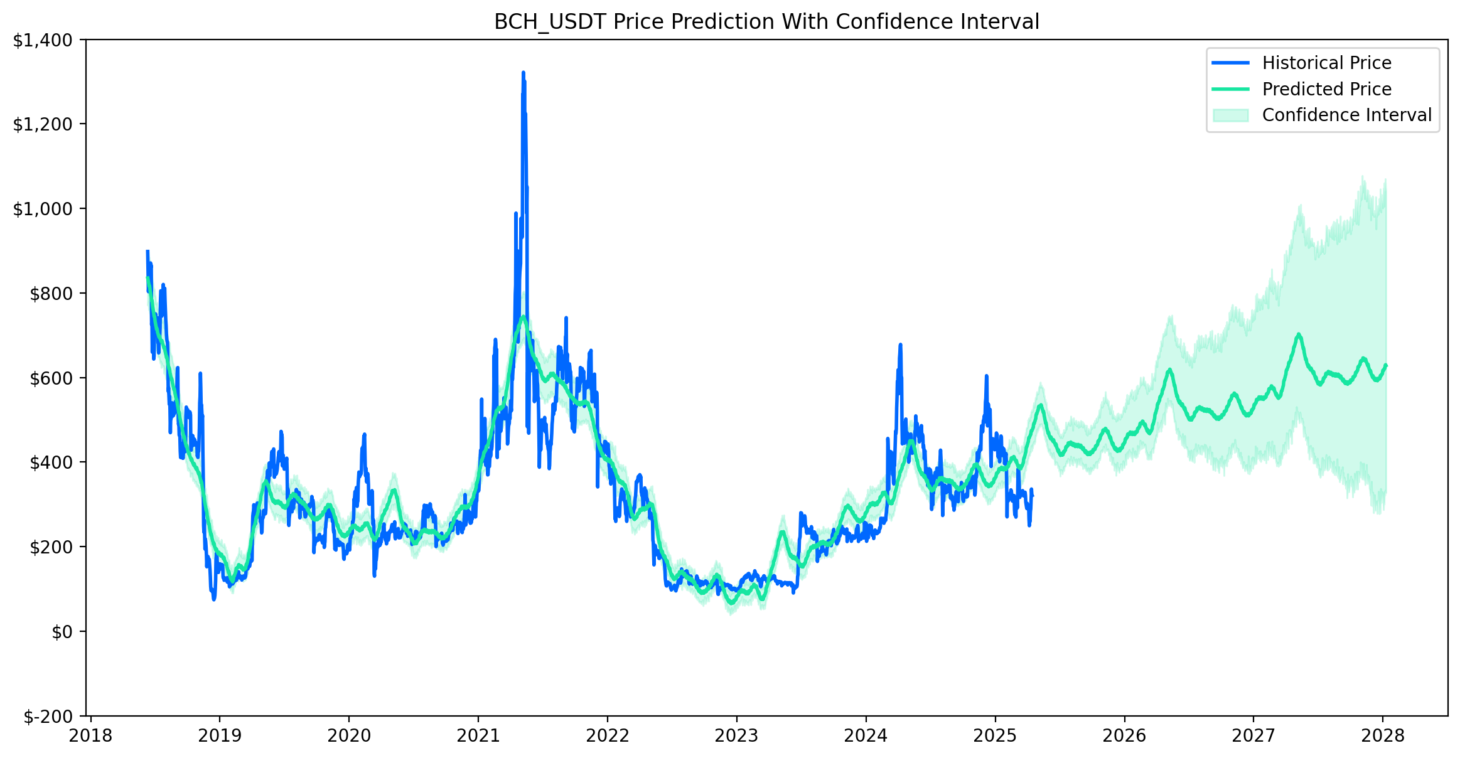

O modelo Prophet AI projeta que o BCH, num futuro próximo, terá um movimento ascendente. Imagem : Previsão de Preço BCH_USDTCom Intervalo de Confiança

Principais impulsionadores: Aceitação institucional abrangente, integração nos sistemas de pagamento e melhorias na escalabilidade e privacidade poderiam impulsionar o BCH. No entanto, a concorrência de outras criptomoedas e possíveis mudanças regulatórias podem moderar as expectativas.

Riscos Potenciais: Fatores macroeconómicos, como recessões ou repressões regulatórias, poderiam abrandar ou reverter as tendências de crescimento a longo prazo. Os investidores devem estar cientes de que essas previsões a longo prazo carregam uma considerável incerteza.

Como comprar $BCH na Gate.io

Passo 1: Registe-se para uma Conta

Comece por visitar Gate.ioe clique em 'Registar' para criar a sua conta. Insira o seu endereço de email, crie uma palavra-passe segura e siga as instruções de registo.

Passo 2: Concluir a Verificação KYC

Para garantir que a sua conta seja segura e cumpra as regulamentações globais, complete o processo de Conheça o Seu Cliente (KYC). Isso geralmente envolve a submissão de um documento de identificação emitido pelo governo e possivelmente uma selfie. A verificação adequada aumenta a segurança da sua conta e desbloqueia todas as funcionalidades de negociação.

Passo 3: Depositar Fundos

Uma vez que a sua conta esteja verificada, deposite fundos na sua carteira Gate.io. Pode utilizar vários métodos, como transferências bancárias, cartões de crédito ou débito, ou até outras criptomoedas. Certifique-se de depositar fundos suficientes para cobrir o investimento desejado, bem como quaisquer taxas aplicáveis.

Passo 4: Localize $BCH

Na secção de negociação da plataforma, utilize a barra de pesquisa para encontrar $BCH. A Gate.io normalmente lista $BCH com vários pares de negociação, como $BCH/USDT. Analise o preço de mercado atual e as opções de ordem disponíveis antes de prosseguir.

Passo 5: Coloque a sua ordem

Decida se quer fazer uma ordem de mercado ou uma ordem de limite. Uma ordem de mercado será executada imediatamente ao preço atual, enquanto uma ordem de limite permite que defina o seu próprio preço. Introduza a quantidade de $BCH que deseja comprar, reveja cuidadosamente os detalhes da ordem e depois confirme a transação.

Como Usar Esta Previsão para Decisões de Investimento

Previsões de preço do BCH são uma ferramenta útil para planear estratégias de entrada e saída, mas não devem ser vistas como conselhos de investimento. Os investidores devem sempre realizar a sua própria pesquisa e considerar análises técnicas e fundamentais. Aqui estão algumas dicas:

Diversifique a sua carteira: Não confie apenas nas previsões de preço do BCH. Uma carteira de criptomoedas diversificada pode mitigar riscos.

Monitorize Indicadores Chave: Mantenha um olhar atento nas médias móveis, níveis de RSI e indicadores MACD. Estes podem fornecer sinais precoces de mudanças de tendência iminentes.

Assistir Notícias Fundamentais: Mantenha-se informado sobre atualizações de blockchain, anúncios regulatórios e indicadores de sentimento de mercado.

Definir Ordens de Stop-Loss: Num mercado tão volátil como o das criptomoedas, proteger o seu capital com ordens de stop-loss é essencial.

Seja paciente: As previsões de preço oferecem uma visão direcional, mas podem não capturar flutuações de curto prazo. Uma perspectiva de longo prazo é crucial para investimentos em criptomoedas.

Conclusão

Bitcoin Cash continua a ser um ativo convincente no diversificado panorama cripto, com foco na escalabilidade e baixas taxas de transação, o que lhe confere uma vantagem única sobre os concorrentes. Enquanto as previsões de preço de curto prazo do BCH para 2025 sugerem uma faixa de negociação potencial de $300 a $800, com perspectivas de ultrapassar os $1.000 em condições ideais, as previsões de médio prazo para 2026-2027 apontam para um crescimento moderado e consolidação, potencialmente preparando o terreno para ganhos mais robustos até 2030.

Aviso: Os investimentos em criptomoedas acarretam riscos. Sempre conduza uma pesquisa minuciosa antes de investir.

Artigos relacionados

Analisando o Hack do Bybit Usando o Ataque de Assinatura Múltipla Radiant como Exemplo

A esplêndida bolha e a verdade perdida das tokens de celebridade

O que é FLock.io (FLOCK)?

Grok AI, GrokCoin & Grok: o Hype e a Realidade

Pippin: Uma nova exploração do framework de IA integrado com MEME