- Pin

- 🗒 Gate.io Suggested Topics Posting Event: #An Open Letter from the Founder of Gate.io#

✍️ Please include the topic #An Open Letter from the Founder of Gate.io# in your post

💰 5 quality posters * each receive $10 Points

🔹 A New Gate to the New Future! Gate.io Founder & CEO Dr. Han releases an open letter on 12th anniversary: Sharing stories behind the brand upgrade. 👉 https://www.gate.io/announcements/article/44649

🔹 Share your wishes or suggestions about Gate.io with the hashtag #An Open Letter from the Founder of Gate.io# to win a share a $50 reward!

⏰ Event Time: April 28, 04:00 AM -

- Where will TRUMP coin land by 8:00 AM UTC, April 30? 🙋

- 🎉 Gate.io Growth Points Lucky Draw Round 🔟 is Officially Live!

Draw Now 👉 https://www.gate.io/activities/creditprize?now_period=10

🌟 How to Earn Growth Points for the Draw?

1️⃣ Enter 'Post', and tap the points icon next to your avatar to enter 'Community Center'.

2️⃣ Complete tasks like post, comment, and like to earn Growth Points.

🎁 Every 300 Growth Points to draw 1 chance, win MacBook Air, Gate x Inter Milan Football, Futures Voucher, Points, and more amazing prizes!

⏰ Ends on May 4, 16:00 PM (UTC)

Details: https://www.gate.io/announcements/article/44619

#GrowthPoints#

- 📢 Gate Post Ambassador are Now Actively Recruiting! 🔥

💪 Join Gate Post Ambassador and embark on an exciting journey of creativity and rewards!

Why Become a Gate Post Ambassador?

🎁 Unlock Exclusive Benefits and Showcase Your Talent

- Special Benefits Tasks – earn while creating

- Exclusive Merch – represent Gate.io in style

- VIP5 & Golden Mark – stand out from the crowd

- Honorary Ambassador – shine in the spotlight

🚀 As an Ambassador, You Will Be:

- A key influencer in the community

- A creative leader in the Web3 space

- A driving force behind top-quality content

🎉 Click the link to be

Web3 Research Weekly Report|The market saw a widespread rise this week; Bitcoin briefly rose to the sixth position in global asset market capitalization.

Weekly Overview

This week, the cryptocurrency market has entered a broad-based rally while experiencing a strong rebound. Influenced by Trump's change in tariff policy and concerns about the Federal Reserve's independence, the crypto market is witnessing a new wave of liquidity and capital inflow, following a significant upward trend alongside the U.S. stock market. Overall, the market is currently in a rapid upward state, with the short-term trend focused on continuous rebound.

This week, most mainstream cryptocurrencies in the market showed a clear upward trend. The market sentiment concerns triggered by Trump's tariff policies are weakening, coupled with the weakening of the dollar due to issues surrounding the independence of the Federal Reserve, resulting in significant gains for the crypto market this week.

Overall, this week the market is still heavily influenced by external factors, but overall liquidity has seen a noticeable improvement, which makes it possible for the market to break free from the previous prolonged stagnation. The overall market trend for the week has been characterized by a rapid rise in a short time, briefly breaking through the $30 trillion mark. Currently, there is a slight pullback as we approach the week’s closing period, and a new round of upward movement in the market is likely to occur.

This week, the price of BTC has risen significantly, currently maintaining a small range of fluctuations after reaching above $93,000, staying around the $93,500 level, with a high probability of setting a new historical high in the short term.

The price increase of ETH over the week is greater than that of BTC. Currently, the price of this cryptocurrency has slightly retreated after breaking above $1800, with the weekly high around $1811, and is currently maintaining around $1766.

This week, the price trends of key mainstream cryptocurrencies are mainly showing a significant upward movement. Currently, the overall market capitalization of the crypto market has increased compared to the same period last week, reaching around $2.93 trillion, with a decrease of about 0.3% in the last 24 hours. The current price of BTC is around $93,500. The current price of ETH remains around $1,760.

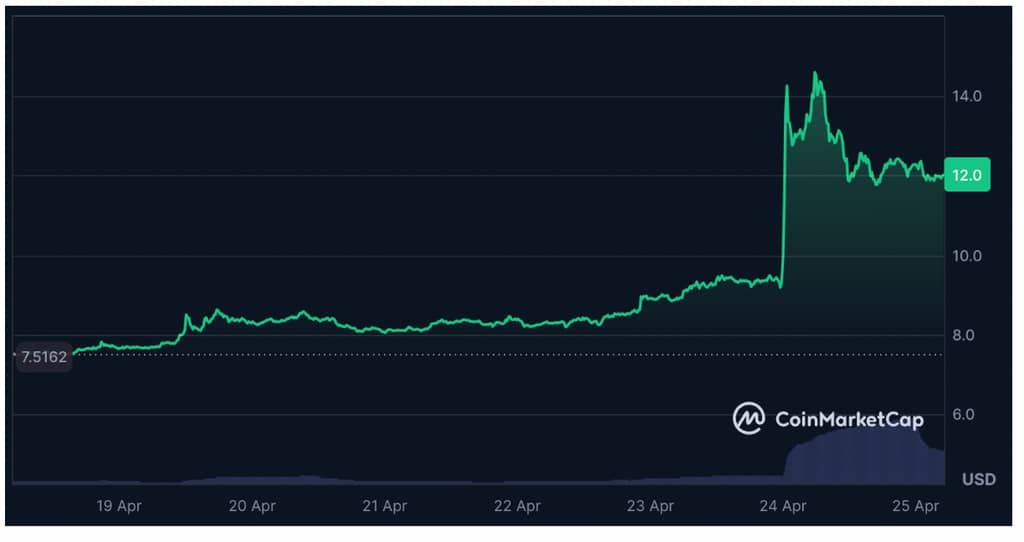

This week, the cryptocurrency market has shown a significant overall increase, with most mainstream coins experiencing price rises influenced by external factors, and the overall average increase is the largest in recent times. The coin with the highest increase this week is TRUMP, which reached around 58% over the week, with a price of about 12 USD. The recent rapid rise of this coin also reflects the ongoing impact of a series of policies following Trump's inauguration on the cryptocurrency market.

This weekend, the cryptocurrency market is likely to maintain slight fluctuations overall, with an upward trend being the main tendency in the short term. However, the rise and fall of major cryptocurrencies are still greatly affected by external news factors, especially the overall issues faced by the upcoming maturity of U.S. Treasury bonds.

Crypto Market

🔥According to a report by Cointelegraph on Monday, Bloomberg senior commodity strategist Mike McGlone stated that investors are turning to safer assets like gold as a result of the recent implementation of Trump's policies.

🔥According to The Block, as of April 20, the seven-day average trading volume of global cryptocurrency exchanges has dropped to approximately $32 billion, the lowest since October 2024, plummeting over 75% from the peak in December 2024.

🔥According to a report by Cointelegraph on Monday, the on-chain analytics platform CryptoQuant warned in its Quicktake blog post that the Bitcoin market is about to experience turbulence.

🔥According to Riabiz, Charles Schwab's newly appointed CEO Rick Wurster is expected to launch direct spot cryptocurrency trading within the next 12 months, with spot cryptocurrency trading becoming the "bet" for every major brokerage.

🔥According to a report by CoinDesk, 21Shares has released a report stating that based on an analysis of historical trends and current market signals, Bitcoin could reach $138,555 by the end of 2025.

🔥According to Cointelegraph, Glassnode data shows that Bitcoin whales are still in a strong accumulation zone, with large holders (whales and sharks) holding more than 100-1000 Bitcoins absorbing Bitcoin at the fastest historical rate, and the current absorption of this group has exceeded 300% of the annual issuance of Bitcoin.

🔥According to LedgerInsights, the Bank for International Settlements (BIS) released a paper this week exploring the financial stability risks of cryptocurrencies and decentralized finance (DeFi). Most central bank officials believe that the scale of cryptocurrencies is too small and self-contained, thus they do not yet pose a financial stability risk.

🔥Tether CEO Paolo Ardoino stated that the global users of Tether stablecoin (USDT) have exceeded 450 million, with over 30 million new users added each quarter, mainly driven by growth in emerging markets. Tether is actively promoting the adoption of the "digital dollar" worldwide.

🔥Greeks.live macro researcher Adam released a Chinese community briefing, stating that market sentiment is divided. Some traders are optimistic about the performance of altcoins over the weekend, believing that SOL has increased over 10 times from the bottom, but there are also views warning that this could be the last frenzy.

🔥According to Bitcoinist, after several days of consolidation, neither bulls nor bears have been able to fully take control of the situation, and this indecision reflects the general uncertainty present in global financial markets.

🔥Strategy (formerly MicroStrategy) founder Michael Saylor has once again released information related to Bitcoin Tracker on the X platform: "The number of orange dots is still not enough."

🔥CryptoQuant analyst Carmelo Alemán stated that the realized capitalization (also known as the realized market value) of Bitcoin reached an all-time high on April 14, 2025.

🔥According to The Block, BTC has hit a new high today for the first time since early April, driven by a global liquidity rebound and increased institutional holdings. Strategy increased its holdings by 3,459 BTC earlier this month, and the growth in M2 money supply has also pushed the market up. However, analysts warn that due to the unclear U.S. tariff policy, it's still too early to say we are in a bull market.

🔥According to sources cited by The Wall Street Journal, a banking consortium including Deutsche Bank and Standard Chartered is considering expanding its cryptocurrency operations to the United States.

🔥Pavel Durov, the founder of Telegram, stated in an official TG channel that last month, France almost banned cryptocurrency technology. The Senate passed a law requiring communication applications to set up backdoors for police access to private information. Fortunately, this law was rejected by the National Assembly. However, three days ago, the Chief of Police in Paris spoke out again in support of this law.

🔥Crypto analyst PlanB posted on X platform, stating that he believes Ethereum, as a "centralized, pre-mined, adopting PoS, and arbitrarily changing supply mechanism" project, is harmful to the crypto ecosystem, and bluntly said it "should be ridiculed by everyone."

🔥According to a chart shared by Bloomberg ETF analyst Eric Balchunas, there are currently 72 crypto asset ETFs involving XRP, Solana, Litecoin, Dogecoin, and even "2x Melania" that have been filed with the SEC in the United States, awaiting approval or listing options.

🔥CryptoQuant Research Director Julio Moreno stated on platform X that the resistance level for Bitcoin price may be around $91,000 to $92,000, an area that coincides with on-chain realization prices for traders.

🔥Jeff Kendrick, an analyst at Standard Chartered Bank, stated that if concerns about the independence of the Federal Reserve persist, Bitcoin could rise to historical highs. He noted that due to its decentralized ledger, cryptocurrency serves as a hedge against the risks of the existing financial system. This was exemplified when the risks of U.S. Treasury bonds became evident after Trump hinted that he might dismiss Federal Reserve Chair Powell due to his desire for interest rate cuts.

🔥Bernstein believes that despite short-term volatility, the outlook for digital assets remains optimistic, and points out five structural catalysts that support Bitcoin's resilience and future upside potential.

🔥According to CoinDesk, the current BTC/NASDAQ ratio is 4.96, close to its historical high. Previously, this ratio set a record of 5.08 in January 2025, when Bitcoin reached an all-time high.

🔥According to the latest data from 8marketcap, Bitcoin has surpassed silver and technology giant Amazon, rising to the sixth position in the global asset market capitalization ranking.

🔥According to Bloomberg, Trump's son has co-founded a new company called American Bitcoin with other investors and merged it with the publicly listed mining firm Hut 8 Corp., which is led by CEO Asher Genoot and Chief Strategy Officer Michael Ho.

🔥According to Globenewswire, Trump Media Technology Group (DJT.O) has signed a binding agreement with the cryptocurrency exchange platform Crypto.com and asset management company Yorkville America Digital to launch a series of ETFs under the Truth.Fi brand.

🔥According to FT, three insiders revealed that Cantor Fitzgerald, led by Brandon Lutnick, son of U.S. Secretary of Commerce Howard Lutnick, is collaborating with SoftBank, Tether, and Bitfinex to create a multi-billion dollar Bitcoin acquisition platform.

🔥According to Cointelegraph, Chiliz, a company under SportsFi, has met with the US SEC to discuss investing and re-entering the US cryptocurrency market under the leadership of a White House that is friendly to cryptocurrencies, as well as increasing efforts for transparency in digital asset regulation.

🔥According to CoinDesk, sources disclosed that Dutch bank ING is developing a stablecoin, hoping to leverage the new European cryptocurrency regulations that took effect last year.

🔥 The official website of the meme coin "TRUMP" by U.S. President Donald Trump announced on Wednesday local time that it will host a dinner for the top 220 holders of the coin on May 22 at a golf club near Washington, claiming there will be an opportunity to hear "first-hand" information from Trump about the future of cryptocurrency.

🔥CoinGecko reported on Thursday that the total market capitalization of cryptocurrencies has exceeded $3 trillion for the first time since March 7, 2025.

🔥According to Cointelegraph, Bitcoin surged significantly this week, with inflows into the related exchange-traded fund (ETF) skyrocketing. Analysts believe Bitcoin could reach $100,000 soon, but Markus Thielen, head of research at 10xResearch, stated in a market report: "Given that the stablecoin minting metrics have not yet returned to active levels, we remain cautious about the sustainability of the current Bitcoin rally."

🔥According to SolanaFloor, Canadian stock exchange-listed company SOL Strategies has obtained up to $500 million in convertible note financing from ATW Partners, which is the largest financing of its kind in the Solana ecosystem.

🔥According to Cointelegraph, the Office of the Comptroller of the Currency (OCC) issued a statement regarding its position on cryptocurrencies and banking, stating: "The OCC has clarified that certain crypto-related activities are legally permitted."

🔥According to a report by CoinDesk, Notabene's latest "2025 Travel Rule Compliance Report" indicates that 90% of the 91 virtual asset service providers surveyed expect to fully comply with anti-money laundering travel rules by mid-2025, and all surveyed institutions have committed to meet the standards by the end of the year.

🔥According to Crypto America, about 15 cryptocurrency and fintech companies are applying for bank licenses from the Office of the Comptroller of the Currency (OCC), with some companies seeking easier ways to obtain a federal master account.

🔥 On-chain analysis firm Glassnode published an analysis on platform X, stating that its Bitcoin supply chart shows strong activity from sellers who first purchased Bitcoin in April. Even as prices rise, the "fear of missing out" (FOMO) sentiment in the market is still increasing, and new funds are flowing in.

🔥James Butterfill, Head of Research at CoinShares, stated on the X platform that since the announcement of the "Liberation Day" tariffs in the U.S. on February 2, Bitcoin's performance has exceeded that of the Nasdaq 100 Index by 15.9%, highlighting its advantages as a decentralized investment asset.

Regulation & Macroeconomic Policy

🔥According to Cointelegraph, a cryptocurrency reserve bill in Arizona has passed in the House and is only one successful vote away from being submitted to the governor's desk for formal approval. On April 17, Arizona's Strategic Digital Asset Reserve Bill (SB 1373) was approved by the full House committee. Before the third and final reading and full vote, the bill needs to be reviewed by 60 members of the House. SB 1373 aims to establish a strategic reserve fund for digital assets, consisting of digital assets seized through criminal proceedings and managed by the state's treasurer.

🔥The Supreme People's Procuratorate's official website recently published a theoretical research article titled "Improving the Identification and Proof Mechanism for Criminal Cases Involving Virtual Currency." The article states that due to the anonymity and technical complexity of virtual currency, there are difficulties in identification, challenges in tracing the flow of funds, and complications in value determination in criminal cases.

🔥The People's Bank of China, the Financial Regulatory Administration, the State Administration of Foreign Exchange, and the Shanghai Municipal Government jointly issued the "Action Plan for Further Enhancing the Convenience of Cross-Border Financial Services in Shanghai International Financial Center."

🔥 U.S. Representative Nydia Velazquez from New York has introduced the "Puerto Rico Digital Asset Fair Taxation Act" aimed at preventing investors from using the U.S. territory of Puerto Rico as a cryptocurrency tax haven.

🔥According to Cointelegraph, the European Central Bank (ECB) has warned about the potential consequences of the U.S. aggressively supporting the cryptocurrency industry, stating that the surge of dollar stablecoins could undermine the stability of the European financial system. A policy document obtained by POLITICO shows that just months after the regulatory framework of the Markets in Crypto-Assets Regulation (MiCA) came into effect, the ECB has called for its revision. The core of the controversy lies in the concern that reforms backed by President Trump in the U.S. could flood the European market with dollar-denominated stablecoins. The ECB fears this could lead to a flow of European capital into U.S. assets, weakening the EU's financial sovereignty and exposing banks to liquidity risks.

🔥According to Watcher.Guru, Michael Saylor stated: "The chairman of the SEC, Paul Atkins, will have a positive attitude towards Bitcoin." Previously, it was reported that Paul Atkins was sworn in to replace Gary Gensler as the chairman of the SEC.

🔥According to a report by Bloomberg, Trump signed an executive order in early March calling for the establishment of a separate strategic reserve for Bitcoin and other tokens, and requested the Treasury Secretary to assess the legal and investment considerations of the plan within 60 days.

🔥According to CNBC, Mark Uyeda, a commissioner of the U.S. Securities and Exchange Commission ( SEC ), participated in the "Money Movers" program to discuss the differences between the current SEC and Gary Gensler's SEC, as well as when to expect a cryptocurrency regulatory framework. Uyeda stated that the cryptocurrency working group is working hard to develop a regulatory framework.

🔥According to official news from the U.S. Securities and Exchange Commission (SEC), SEC Chairman Paul Atkins will speak at the next cryptocurrency roundtable on April 25. Previously, it was reported that the SEC will hold its third cryptocurrency policy roundtable on April 25, focusing on custody issues.

🔥According to Interfax, the Russian Ministry of Finance and the Central Bank will establish a cryptocurrency exchange aimed at high-net-worth investors as one of the compliance mechanisms under a "experimental legal regime." Participants must have assets exceeding 120 million rubles or an annual income over 50 million rubles. The plan aims to legalize crypto trading and enhance market transparency, but it is limited to foreign trade settlements and does not apply to domestic payments. Related transactions will begin a pilot program in six months.

Highlights of the Cryptocurrency Market

⭐️Over the past week, the cryptocurrency market has experienced a significant upward trend, influenced by a reduction in concerns over Trump's tariff policies and issues regarding the independence of the Federal Reserve. Both the US stock market and the crypto market have seen a noticeable rebound, with the crypto market experiencing a broad-based rally. In the past week, mainstream cryptocurrencies have primarily seen short-term rapid rises. Currently, the market is in a slight fluctuation, and it is expected that this trend will continue to increase.

⭐️This week, the TRUMP cryptocurrency has seen the highest increase among mainstream coins, reaching around 60%. This surge is mainly due to the coin being officially certified by Trump, and its price has shown a rapid rise influenced by recent developments related to Trump. Currently, the price of TRUMP has slightly retreated, maintaining around 12 dollars, with a weekly high of approximately 14.6 dollars. It is currently in a short-term volatile trend, with the price remaining relatively stable.

Bitcoin & Ethereum Weekly Performance

Bitcoin (BTC)

This week, the price of BTC has shown a continuous upward trend after the opening, with prices briefly breaking above $94,000. Following that, there was a slight decline, but it still remains within a relatively high price range recently. Influenced by external news factors, the price of BTC reached a historical high this week, with the overall capital scale reaching the sixth largest asset globally. In the short term, BTC prices are likely to continue an upward trend, with small fluctuations in price being the mainstream trend.

Ethereum (ETH)

The price trend of ETH has risen more significantly than BTC this week, but the short-term fluctuations are also larger. The price of ETH reached a peak above $1800 within the week. Currently, the price of ETH is around $1760, and the subsequent trend is likely to remain within a small range of continuous fluctuations, but there is considerable upside potential. It is expected that there will be some price changes during the weekend.

Web3 Project Trends

This week, the total market value of seven types of projects has risen across the board, with the magnitude reaching a recent high. The market has seen an upward warming trend influenced by external factors. As a result, most sectors have mainly experienced a rebound. It is expected that the current main trend will continue into the weekend closing period, with a slight upward movement being a high-probability scenario.

| Project Category | Weekly Change | Top Three Tokens by Weekly Increase | Overview | | ------------ | ------------ | ------------ | ------------ | | Layer 1 | 11.5%| PAC,MIRAI,KRU | The market capitalization of the Layer 1 track has significantly increased this week, with the top cryptocurrencies maintaining a moderate increase, and the overall distribution being relatively even.| | Layer 2 | 24.2% |BB,RENTA,MERL|The Layer 2 sector experienced a significant rebound this week, but the overall average increase is relatively balanced, and the leading cryptocurrencies have moderate and not excessive gains.| | DeFi | 15.1% | PBTC, COMBO, FLURRY | The total market value of the DeFi sector has seen a significant recovery this week, but the increase in top-performing coins is mainly concentrated on a few specific coins, continuing the trend seen last week. | NFT | 24.6% | DREAMS, CHMPZ, YAKA | The total market value of NFTs rebounded significantly this week, but the top rising coins are still mainly comprehensive projects, with the overall increase being relatively evenly distributed. | MEME | 21.3% | CATX,CATME,UNI| The MEME coin sector saw a significant increase this week, but it was mainly concentrated on a few leading cryptocurrencies, with considerable differences within the sector.| | Liquid Staking | 12.6% | QCKUJI,BRG,RAPR | This track has seen a certain degree of increase this week, but the top rising coins have relatively concentrated gains, and compared to other tracks, the increase is actually quite limited.| | AI | 21.8% | MINDS,SUIDEPIN,SENT | The AI sector saw a significant rebound this week, but the increase in the leading coins was concentrated on a few specific coins, while the overall rise of other coins in the sector was relatively small.|

Author: Charles T., Gate.io researcher *This article only represents the author's views and does not constitute any trading advice. Investment carries risks, and decisions should be made cautiously. *This content is original and the copyright belongs to Gate.io. If you need to reprint it, please indicate the author and source, otherwise, legal responsibility will be pursued.