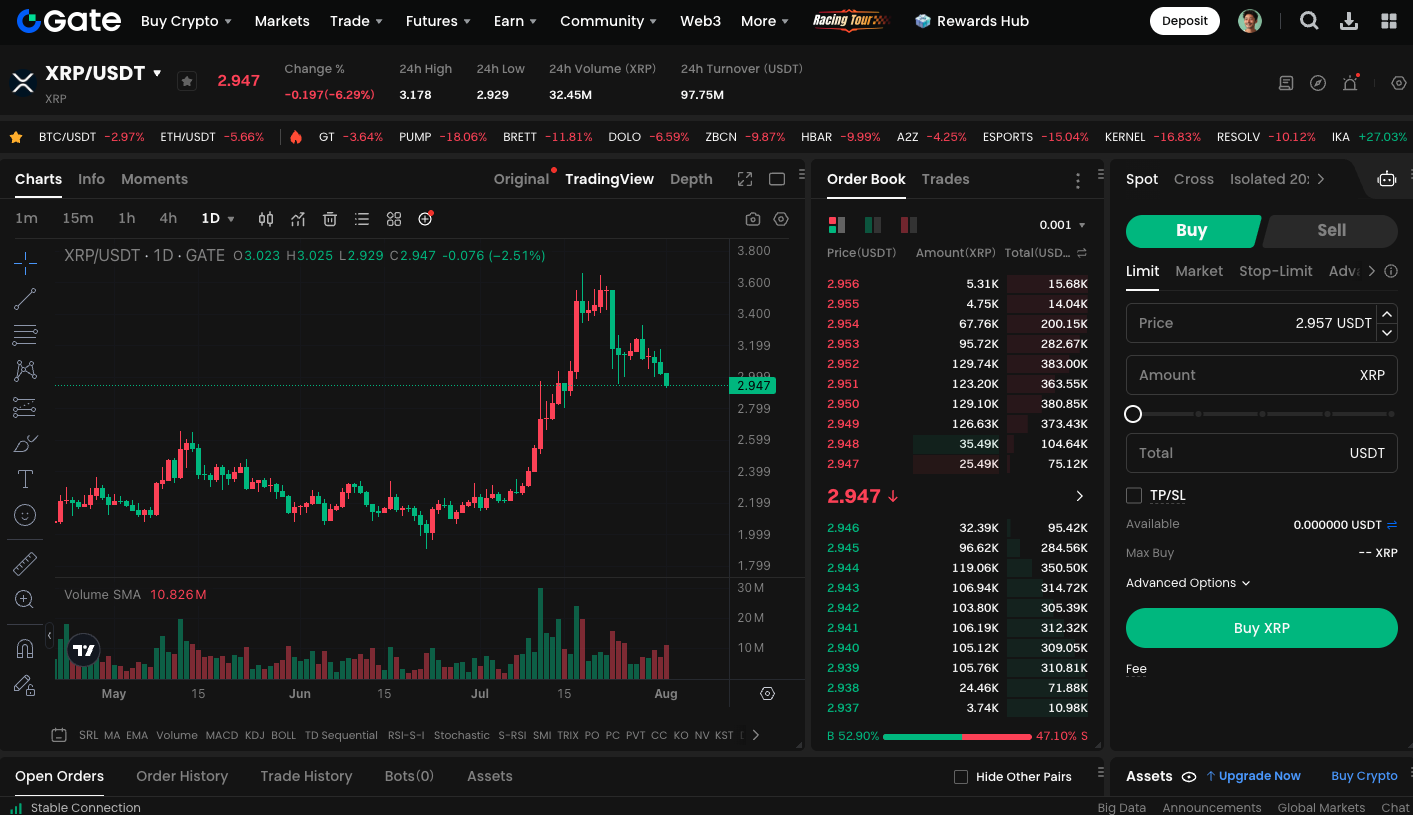

XRP Price Prediction: XRP Pulls Back to $2.95 While 86% ETF Approval Odds Fuel Bullish Outlook

XRP Bulls and Bears Locked in Fierce Battle

Crypto analyst Thecafetrader underscores that XRP is currently at a crucial inflection point between bull and bear sentiment. While significant capital inflows primarily fueled the previous price surge and managed to break the 2024 high, trading volume has shrunk at these elevated levels, suggesting buying momentum is waning.

For instance, when XRP first surpassed the $3 threshold, daily trading volume surged as high as $78 billion. By contrast, at its latest peak of $3.6, volume had dwindled to just $41 billion. This highlights a clear drop in buyer confidence. Although selling pressure has not made a strong comeback. The market lacks fresh buying activity, leaving prices uncertain. The analyst notes that if bulls are unable to hold the $2.95 support, XRP could slide to $2.3—or even as low as the $1.6 zone. Still, he adds, these lower levels could attract value-seeking buyers looking to enter on the dip.

Spot ETF Approval Odds Surge

Recent guidance from the U.S. Securities and Exchange Commission (SEC) has dramatically increased the odds that leading cryptocurrencies—XRP included—could see spot ETFs reach the market.

Under the new rules, any crypto asset that has traded continuously on a futures platform (such as CME) for at least six months is now eligible to apply for a spot ETF. This policy not only shortens review periods. It also simplifies the approval process, cutting the maximum timeline from 240 days to just 75 days. The adoption of in-kind creation and redemption for ETFs means authorized participants can directly swap crypto assets for ETF shares, reducing costs and improving operational efficiency.

ETF Approval Probability at 86%

Bloomberg analyst Eric Balchunas reports that if everything stays on track, there’s an 85% chance that an XRP ETF will be approved in September or October 2025. Polymarket data at press time shows the probability for an XRP spot ETF being approved in 2025 is as high as 86%.

(Source: Polymarket)

That said, the ongoing lawsuit between Ripple and the SEC remains a key factor. Both parties could drop their appeals ahead of the August 15 status report. If this happens, it would remove the final legal hurdle. Former SEC attorney Marc Fagel notes that once litigation is withdrawn, the only step left for an XRP spot ETF listing would be regulatory clearance.

You can trade XRP spot: https://www.gate.com/trade/XRP_USDT

Summary

XRP has declined nearly 20% off its recent highs. Both technical and regulatory developments continue to demonstrate strong medium- and long-term growth potential. If XRP can hold $2.95 over the next few weeks and garner additional institutional and policy support, it may be poised to challenge $4.6 again. It could set new all-time highs if a spot ETF is launched.