豪掷 8000 万美元「补贴」做增长,Uniswap 步子迈得有点大

Uniswap 推出高达 8000 万美元的流动性激励计划,意图推动 v4 和 Unichain 增长,引发社区对资金效率、风险管理与长期回报的激烈讨论。本文全面解析提案内容、技术架构、质疑声音与用户参与方式,助你理性判断这场增长豪赌。在 2025 年 2 月 14 日 Uniswap 基金会的执行董事兼联合创始人 Devin Walsh 在 Uniswap 治理 DAO 中发起关于 Uniswap v4 以及 Unichain 的流动性激励提案,该提案在 3 月 3 日在 Snapshot 上通过 Temp Check 后,最终于 3 月 21 日在 tally 正式完成最终提案,共 5300 万枚 UNI、468 个地址参与投票。该计划的技术支援 Gauntlet 宣布该计划的首期活动将持续 2 周,并于 4 月 15 日开启。

该提案一经发出引发了社区的激烈讨论,有人表示支持,也有人认为这个计划无意义是对 DAO 利益的损害。本文将详述该计划的主要内容,如何参与以及社区的看法。

提案详情

该提案同时包含对 UniSwap v4 未来六个月以及 Unichain 未来一年的计划,基金会针对 Uniswap v4 的目标是在未来六个月要将 v3 上 328 亿美元的 30 天滚动交易量迁移到目标链上的 v4,为该六个月的计划共申请了 2400 万美元的预算。

而 Unichain 的活动则是计划实行一整年,Uniswap 基金会对未来三个月的计划是实现 Unichain 7.5 亿美元的 TVL 和 110 亿美元的累计交易量,为实现上述目标,Unichain 计划在第一年内请求约 6000 万美元的激励「包括这次请求的 2100 万美元」。与 Uniswap v4 类似的方式运行,但奖励将考虑非 DEX 的 DeFi 活动,以增加流动性有机需求「主要由 Uniswap 基金会和其他在 Unichain 上构建的项目组成」。

两条链的激励活动稍微有些差异,Uniswap v4 的活动将专注于推动每条链上的 AMM 交易量,而 Unichain 的活动将更战略性地部署 AMM 激励措施,以促进整个链以及 AMM 内部更广泛的 DeFi 活动。

首次 Unichain 活动将于 2025 年 4 月 15 日启动,为期三个月,发放数百万美元的激励资金。$UNI 激励措施将分布在 12 个不同的 Unichain 池中奖励 LP,前两周以下 12 个矿池将获得 $UNI 奖励: $USDC /$ETH、$USDC /$USDT0、$ETH/$WBTC、$USDC/$WBTC、$UNI / $ETH、$ETH / $USDT0、$WBTC /$USDT0、$wstETH/$ETH、$weETH/$ETH、$rsETH/$ETH、$ezETH/$ETH、$COMP/$ETH。

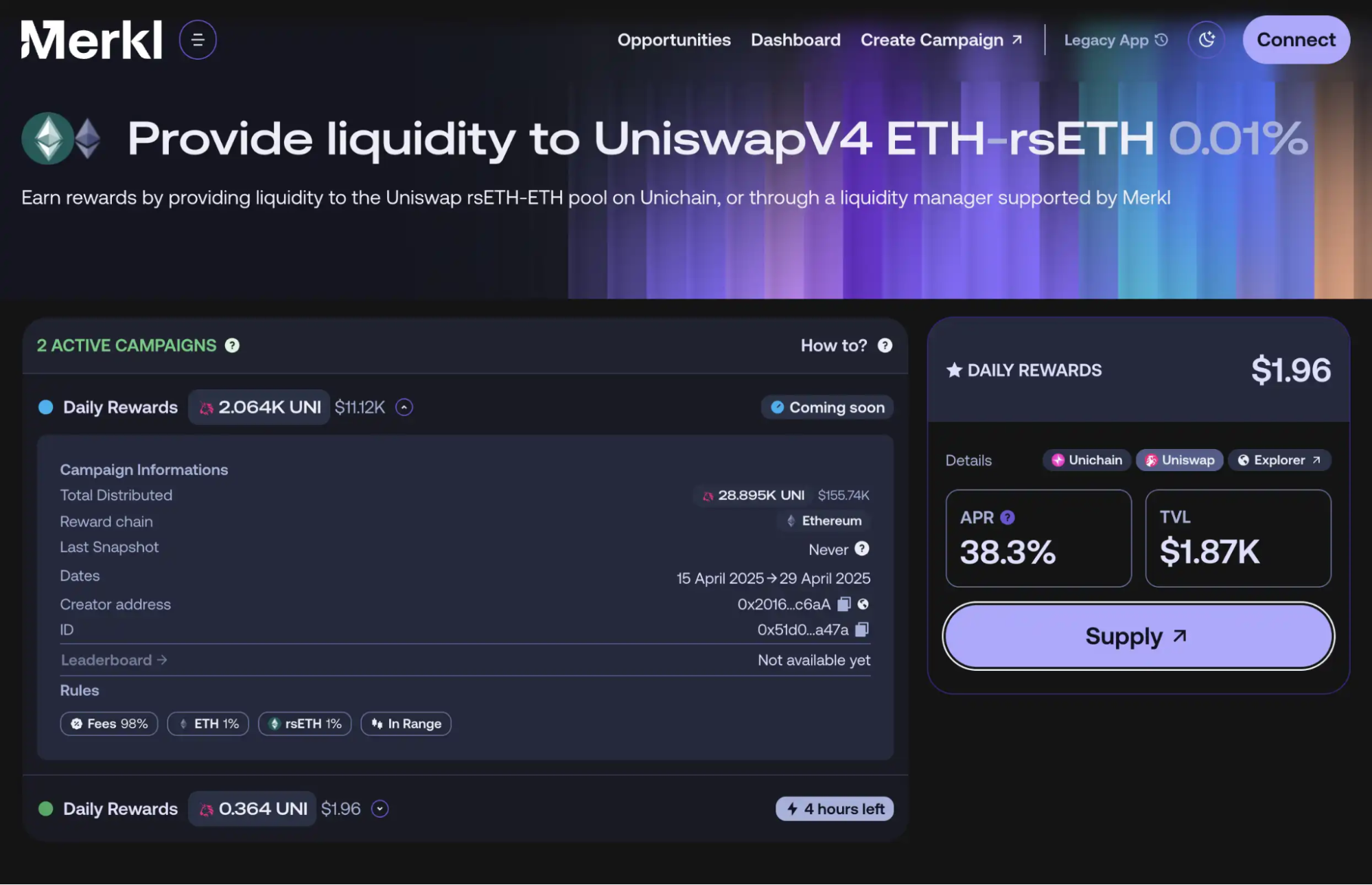

此次活动中,Gauntlet、Merkl 发挥着很大的作用,Gauntlet 是一个用于链上风险管理的模拟平台,利用基于代理的模拟来调整协议的关键参数,从而提高资本效率、费用、风险和激励。Merkl 则是由 a16z 孵化,集成了多条链以及协议的 DeFi 投资机会的一站式平台。

此次活动 Gauntlet 提供旗下的「Aera」保险库技术,在 DAO 投票通过资金申请后存于保险柜中,由 Gauntlet 确定每个网络上交易量最高的流动性池,并计算使 Uniswap v4 成为更具有经济吸引力的选择,所需的额外收益。以两周为单位进行一次调整,而选择哪些池子能够获得多少激励以及领取奖励,这些都将在Merkl 网站上公布。

激进的增长目标,老套的增长策略

激励效果以及后续留存的讨论

成员「UreNotInD」在 Dao 投票的讨论中首先反对了这个提案,主要原因是在提案中提出需要的资金时,类比了其他项目在流动性上花费的资金「Aerodrome 每月 4000-5000 万美元、ZkSync Ignite9 个月 4200 万美元、Arbitrum 自去年 3 月以来花费近 2 亿美元」,他认为这是一个许多项目已经尝试过的老套策略且收效甚微。

而目前最强劲的竞争对手 Fluid 在没有提供任何激励的情况下正在抢占市场份额。最受欢迎的 L2 网络 Base 在没有用户激励的情况下成功获得了市场份额。这些措施没有解决能够帮助 Unichain 增长的结构性问题,而超级链之间的互操作性、为 DeFi 开发独特的使用场景、改善链上原生资产发行「RWA、迷因币、AI 代币」,原生资产才是最具粘性的,基金会应该通过以上方式吸引并资助更多开发者。

成员「0xkeyrock.eth」也有相同的担忧,他认为 Gauntlet 的报告应在论坛中公开分享。这份报告花费了大量资金,但在论坛中展现的信息却十分肤浅,不足以支撑如此大规模激励的合理性。

他提出了几个报告中不合理的点。例如,Aerodrome 的高激励是因为 100% 的费用都重新分配给了 veHolders,而无法与该类流动性激励做比较。其次,zkSync 每月 500 万美元的代币奖励才将 TVL 从 1 亿美元提升到 2.66 亿美元。

而此时 Unichain 的总 TVL 仅 1000 万美元,这显示市场对 Unichain 的内在需求不足。Gauntlet 声称能够用每月 700 万美元的激励将 Unichain 提升到 7.5 亿美元的 TVL 似乎缺乏真实性。

而即使通过激励补贴活动可能暂时提升活跃度,但需求如何持续,历史案例如 MODE「TVL 从 5.75 亿降至 1900 万」、Manta「6.67 亿降至 4600 万」、Blast「22.7 亿降至 2.33 亿」表明 Unichain 可能面临相同的结局。

在此基础上,从 Forse Analytics 此前对比的 UniSwap 在各条链的激励的「每美元可获得的 TVL 增长」数据以得知,在 L2 中基础设施最完善的 Base 中,最佳情况是每美元可以获得 2600 美元的 TVL,而对比表现最差的 Blast 则是约 500 美元。若要达到 7.5 亿美元 TVL 的目标,简单计算前者每天需要 30 万美元而后者则需要 150 万美元。

虽然类比数据不够完善,但是能够代表一定的比例范围区间,若要用 700 万美元在三个月内将 Unichain 的 TVL 提升至 7.5 亿美元,需要提升周边基础设施完善度以及用户水平至与 base 相似,而其中表现最差的 Blast 链目前的 TVL 还是 Unichain 的 10 倍以上。

该成员还同时分享了 2024 年 Uniswap v3 在新链部署时的激励计划的活动结果数据,效果最好的是 Sei 在该链生态中的 DEX TVL 排名第 6,TVL 仅 71.8 万美元,最差的 Polygon zkEVM 甚至 TVL 仅 2600 美元,DEX TVL 在该链生态中排名第 13。这些部署的 TVL 均未超过 100 万美元,几乎没有一个进入所在链的顶级 DEX。这些部署大多完全失去了活力,唯一的交易量来自套利者修复过时的价格。

0xkeyrock.eth 制作的表格,为 Uniswap 在多条链部署激励后收获的 TVL 以及在 DEX 中的排名

而这些激励池部署几乎都未产生飞轮效应,在活动结束后呈现断崖式下跌。Uniswap 在这些部署上花费了 275 万美元「不包括协议中的匹配金额」,而这些部署的年化费用为 31 万美元。即使采用费用转换来收回费用「假设占比 15%」,DAO 每年仅能获得约 4.65 万美元的收入,相当于 1.7% 的回报率,并且需要 59 年才能实现收支平衡。

两条虚线间为激励活动区间,可以看到几乎所有流动性池在活动后都呈现断崖式下跌

当然也有成员表示虽然激励结束后普遍存在流动性断崖式下跌的情况,但这个激励计划仍然最有效策略。成员「alicecorsini」以Forse Analytics 最近对 Base 上 Uniswap v3 的 UNI 激励回顾的数据来显示出在激励结束后保留用户、流动性和交易量的困难。

以 base 来说 Uniswap 最大的竞争对手是 Aerodrome,而数据呈现了一个更复杂的情况。27.8% 的 Uniswap 激励 LPs 在激励结束后为 Aerodrome 提供了流动性,其中 84.5% 完全离开了 Uniswap,而约 64.8% 离开 Uniswap 的用户也没有转向 Aerodrome,即使他们拥有比无激励的 Uniswap v3 更好的 APR。

虽然一些 LPs 转向了 Aerodrome,但更大比例的用户只是直接退出,而非投向直接竞争对手。这表明在保留用户和流动性方面存在更广泛的结构性挑战。他认为在部署激励的「同时」头脑风暴一些提高保留率的方法是一项值得努力的工作,但这个激励计划仍然是是流量漏斗第一步的最有效策略。

社区对 Gauntlet 能力的怀疑

社区成员 Pepo「@0xPEPO」在社交媒体 X 上表达了自己对 Gauntlet 的担忧,他指出 Uniswap 基金会甚至在提案获得批准之前就已经向 Aera 和 Gauntlet 分别支付了 120 万美元和 125 万美元的参与费用。而 Aera 团队是否有能力完成这样的项目却缺乏业绩记录。

他提到 Gauntlet 指定的 Uniswap 增长经理 Peteris Erins 曾是 Auditless 的创始人和 Aera 团队成员。尽管 Peteris 除了他在 Aera 的工作之外,几乎没有公开的业绩记录。唯一值得注意的公开成就是其协议在第一年就达到了超过 8000 万美元的 TVL。

然而,他认为这一总锁定价值可能并非真实的业绩表现,Aera 的每一位客户也是 Gauntlet 的客户,当一家企业的业绩依赖于其母公司时,增长的数据就值得怀疑了。他进一步举出 Aave 和 Gauntlet 的数据。数据表明,Gauntlet 可能一直在抑制增长,在 Aave 在与 Gauntlet 分道扬镳后,其 TVL 和盈利能力都得到了显著提升。

Uniswap 基金会的执行董事兼联合创始人 Devin Walsh 对此的回应是 Gauntlet 经历了更比以往典型的合作者更严格的审查,已经经历了两次尽职调查过程。

第一次是在 2023 年初,当时正在甄选一位顾问进行激励分析。为了选择供应商,我们向三位潜在的合作者提供了类似的提案,我们根据分析的严谨性、全面性以及分析后推动执行的能力对最终结果进行了评估。而当时 Gauntlet 的成果远超其他公司。第二次是 2024 年第三季度,基金会对一批候选人进行了评估,以确定谁最适合合作开展 Uniswap v4 和 Unichain 的激励活动。我们评估了候选人的过往记录、相关经验以及实现预期成果的能力。基于分析,我们认为 Gauntlet 最适合承担这项任务。与此同时,我们也借此机会重新协商了合同,目前计划按活动次数付费,并将费率锁定至 2027 年。

多次出现的 USDT0 底层技术 Layer0 的安全问题

在活动开始前,分析员 Todd「0x_Todd」在社交媒体 X 中指出了 USDT0 存在的安全隐患问题。USDT0 是 USDT 的跨链版,母资产 USDT 存在 ETH 上,通过 Layer0 跨链到其他链上就变成了 USDT0。支持 USDT0 的链之间还可以相互跨链,例如 ETH-Arb-Unichain-熊链-megaETH 等等。

USDT0 由 Everdawn Labs 主导,使用了 Layer0 的底层技术,并获得了 Tether 和 INK 的背书。Todd 表达了对 Layer0 的信任问题,「我对 Layer0 信任程度是有限的,而过去那些顶级跨链桥翻车的案例比比皆是,从 multichain 到 thorchai,跨链这个技术根本没门槛,无非就是多签而已」 \

因为当前情况除了需要承担 Tether 和 Uniswap 两个风险,还需要额外再承担 4 个风险,即 Everdawn 的安全性、Layer0 的安全性、Unichain 的安全性、以及其他支持 USDT0 的公链的安全性。如果其他公链被黑了,USDT0 无限增发,那么 Unichain 的 USDT0 也会被污染。

用户如何薅羊毛?

进入Merkl查看激励池,这些激励机制可能会随着时间的推移而增加或减少,如果想要高效的挖$UNI 的话,需要随时关注 12 个池子的奖励变化。

为这些池子提供流动性,可以从任何界面向激励池提供流动性,并获得流动性活动奖励。

在 Merkl 个人界面领取奖励,用户可以通过 Merkl 接口或任何连接到 Merkl API 的接口来领取奖励。

总的来说,大部分的社区用户并不看好这个提案,他们认为在各个方面来说对$UNI 持有者的权益都是有危害的,但对单纯想要在其中挖$UNI 的散户来说,需要小心其中可能发生的风险以及注意每两周一次的流动性池奖励变化。针对后续可能存在的风险律动 BlockBeats 将持续跟踪报道。

声明:

本文转载自 [BlockBeats],著作权归属原作者 [BUBBLE],如对转载有异议,请联系 Gate Learn 团队,团队会根据相关流程尽速处理。

免责声明:本文所表达的观点和意见仅代表作者个人观点,不构成任何投资建议。

文章其他语言版本由 Gate Learn 团队翻译, 在未提及 Gate.io 的情况下不得复制、传播或抄袭经翻译文章。

相关文章

什么是比特币?

Gate 研究院:2025 年 Q1 加密货币市场回顾