HyperEVM et Intégration de Smart Contract

Ce module explore HyperEVM, sa compatibilité avec Ethereum, le déploiement de contrats intelligents, l'interopérabilité avec d'autres blockchains et les cas d'utilisation au sein de l'écosystème Hyperliquid.

Introduction à HyperEVM et à sa compatibilité avec Ethereum

HyperEVM est une machine virtuelle Ethereum (EVM) intégrée à la blockchain de la couche 1 (L1) de Hyperliquid. Contrairement aux modèles de chaîne séparée, HyperEVM fonctionne au sein de la même couche de consensus, HyperBFT, qui sécurise l'ensemble du réseau L1. Cette intégration permet à HyperEVM d'interagir directement avec les composants natifs de la blockchain Hyperliquid, tels que les carnets d'ordres perpétuels et en spot on-chain.

La compatibilité avec Ethereum signifie que les développeurs familiers avec l'écosystème d'Ethereum peuvent déployer leurs applications décentralisées (dApps) et contrats intelligents sur Hyperliquid sans modifications importantes. Cette interopérabilité facilite la migration des projets existants basés sur Ethereum vers Hyperliquid, leur permettant d'utiliser l'infrastructure haute performance d'Hyperliquid tout en maintenant les fonctionnalités de l'environnement Ethereum.

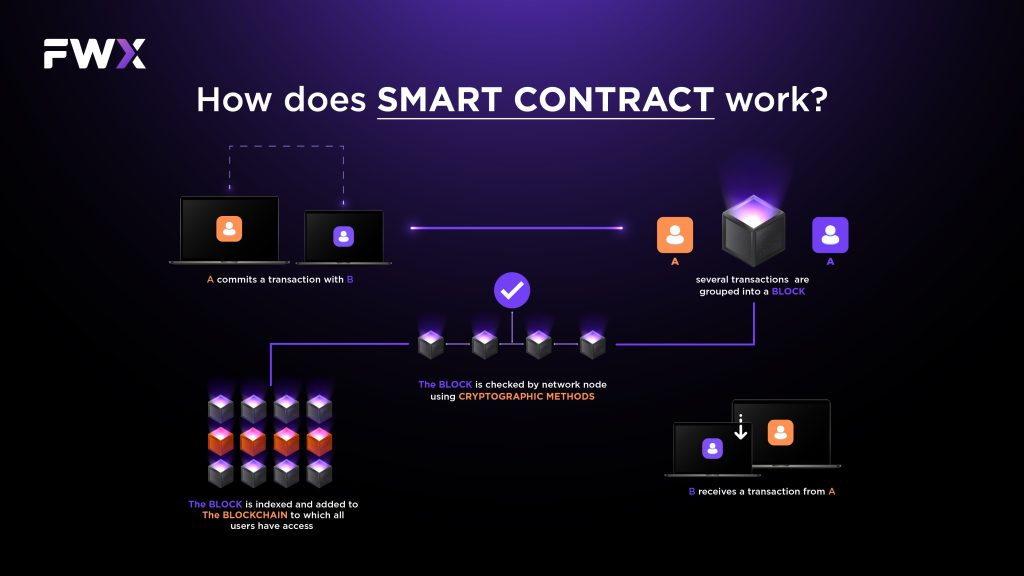

Déploiement de Smart Contracts sur Hyperliquid

Le déploiement de smart contracts sur Hyperliquid implique l'utilisation de l'environnement HyperEVM, qui est entièrement compatible avec Solidity, le langage de programmation principal pour les smart contracts Ethereum. Les développeurs peuvent créer, compiler et déployer leurs smart contracts sur la blockchain de Hyperliquid, en bénéficiant de l'architecture à haut débit et faible latence de la plateforme. Cette compatibilité garantit que les développeurs Ethereum peuvent facilement migrer leurs dApps existantes et leurs smart contracts vers l'écosystème Hyperliquid avec des ajustements minimes.

HyperEVM opère au sein de la blockchain de couche 1 (L1) et s'intègre directement aux fonctionnalités natives de Hyperliquid. Cela permet aux smart contracts d'interagir avec des composants critiques on-chain tels que les carnets de commandes et les données de transaction en temps réel. Par exemple, une application financière déployée sur Hyperliquid peut accéder directement et utiliser les données de trading du carnet de commandes entièrement on-chain de la blockchain, permettant aux développeurs de créer des protocoles de finance décentralisée (DeFi) sophistiqués et des systèmes de trading.

Hyperliquid fournit des outils de développement complets et une documentation détaillée pour faciliter le processus de déploiement. Les développeurs peuvent accéder à l'environnement HyperEVM sur le testnet, qui sert de bac à sable pour l'expérimentation et les tests avant le déploiement en mainnet. Cette approche permet aux développeurs de valider leur logique et leur fonctionnalité de contrat intelligent dans des conditions réelles tout en garantissant la compatibilité avec l'infrastructure de Hyperliquid.

Les développeurs peuvent connecter leurs portefeuilles et leurs outils, tels que MetaMask, au réseau de test Hyperliquid en configurant les paramètres réseau appropriés. Cette interface familière simplifie le processus de déploiement, permettant aux développeurs d’interagir avec leurs contrats à l’aide d’outils Ethereum standard. L’utilisation d’outils bien établis permet aux développeurs de se concentrer sur la création de leurs applications plutôt que de s’adapter à des plates-formes inconnues.

Hyperliquid propose également des contrats système qui offrent un accès direct aux données de la couche 1. Ces contrats permettent aux développeurs d'intégrer des informations blockchain en temps réel dans leurs smart contracts, garantissant ainsi une fonctionnalité précise et à jour. Par exemple, les contrats système peuvent fournir des données de marché ou l'historique des transactions à des protocoles DeFi qui nécessitent des inputs précis pour exécuter des transactions ou calculer des récompenses.

L'interopérabilité de HyperEVM avec Ethereum élargit considérablement son potentiel d'application. Les développeurs peuvent migrer des projets basés sur Ethereum vers Hyperliquid avec des modifications minimales, préservant les fonctionnalités existantes tout en bénéficiant de l'environnement blockchain haute performance de Hyperliquid. Cette compatibilité prend en charge une gamme de cas d'utilisation, y compris la tokenisation d'actifs, les systèmes de trading automatisés, les protocoles de prêts décentralisés et les applications de gouvernance.

Le déploiement de contrats intelligents sur Hyperliquid permet aux développeurs de créer des applications qui interagissent efficacement avec les composants natifs de la blockchain. L'intégration de HyperEVM avec la blockchain de couche 1 crée des opportunités pour des applications en temps réel et axées sur les données dans l'écosystème DeFi. En offrant une expérience de développement simplifiée et une compatibilité avec les outils Ethereum largement utilisés, Hyperliquid se positionne comme une plateforme pratique et polyvalente pour le développement d'applications décentralisées.

Interopérabilité avec d'autres réseaux blockchain

Le design de Hyperliquid met l'accent sur l'interopérabilité avec d'autres réseaux blockchain, en particulier Ethereum. L'intégration de HyperEVM facilite cela en permettant aux dApps compatibles avec Ethereum et aux smart contracts de fonctionner sur Hyperliquid sans nécessiter de changements importants. Cette compatibilité s'étend également aux actifs, permettant le pontage des jetons ERC-20 vers l'écosystème de Hyperliquid.

L'infrastructure prend également en charge le développement d'applications inter-chaînes, permettant des interactions entre Hyperliquid et d'autres réseaux blockchain. Cette interopérabilité crée un écosystème cohérent de finance décentralisée (DeFi) où les actifs et les données peuvent circuler librement entre différentes plateformes, améliorant ainsi la liquidité et l'engagement des utilisateurs.

Cas d'utilisation et applications au sein de l'écosystème Hyperliquid

L'intégration de HyperEVM et des capacités de smart contract ouvre un large éventail de cas d'utilisation au sein de l'écosystème Hyperliquid :

- Applications de finance décentralisée (DeFi) : Les développeurs peuvent créer des protocoles DeFi tels que des plateformes de prêt, des créateurs de marchés automatisés (AMM) et des stratégies de farming de rendement, en utilisant l'infrastructure haute performance de Hyperliquid.

- Trading de dérivés: Les contrats intelligents peuvent faciliter le trading de contrats à terme perpétuels et d'autres instruments dérivés, interagissant directement avec les carnets de commandes sur la chaîne pour une exécution en temps réel.

- Tokenisation des actifs : la tokenisation des actifs du monde réel peut être mise en œuvre, permettant la propriété fractionnée et une négociation efficace sur la plateforme décentralisée de Hyperliquid.

- Mécanismes de gouvernance : Les organisations autonomes décentralisées (DAO) peuvent tirer parti de l'infrastructure de Hyperliquid pour exécuter des processus de gouvernance sur chaîne, garantissant une prise de décision transparente.

- Ponts inter-chaînes : Les développeurs peuvent créer des solutions qui relient les actifs entre Hyperliquid et d'autres blockchains, améliorant l'interopérabilité au sein de l'écosystème blockchain plus large.

Points forts

- HyperEVM permet des contrats intelligents compatibles avec Ethereum dans la blockchain de la couche 1 d'Hyperliquid.

- Les contrats intelligents interagissent directement avec les fonctionnalités natives de la blockchain, y compris les carnets d'ordres sur chaîne.

- Les outils de développement et le support du testnet simplifient le déploiement et les tests.

- L'interopérabilité avec Ethereum permet des applications inter-chaînes et le pontage d'actifs.

- Les cas d'utilisation incluent les protocoles DeFi, le trading de dérivés, la tokenisation, les DAO et les solutions de chaîne croisée.