Gate 研究院:SUI 市值超越 LINK,Gate.io 推出全新空投平台 CandyDrop

Gate 研究院日報:4 月 25 日,比特幣報 93,176 USDT,以太坊報 1,752.39 USDT。聯準會撤銷銀行加密監管指導,Sui 推出虛擬萬事達卡,Securitize 與 Mantle 推出加密指數基金。Solana 穩定幣市值創新高,SUI 市值超越 LINK,Uniswap 總交易量逼近 3 萬億美元。摘要

- 比特幣價格漲 0.31% 至 93,176 USDT;以太坊下跌 1.24% 至 1,752.39 USDT。

- 聯準會撤銷對銀行加密業務的監管指導,釋放監管松動信號。

- Sui 推出數字版萬事達卡,支持歐洲用戶使用加密支付。

- Securitize 聯手 Mantle 推出機構加密基金,瞄準“加密版 S&P 500”。

- SUI 市值超越 LINK,ETF 熱點與 Meme 幣助推幣價上行。

- Solana 穩定幣市值創下 128.85 億美元新高。

行情點評

- BTC —— BTC 價格在過去 24 小時內小幅漲 0.31%,目前報 93,176.6 USDT。圖表顯示,BTC 在 91,778 至 94,301 USDT 區間內震蕩整理,價格多次測試上軌壓力但未能有效突破,短線走勢圍繞 5 日與 10 日均線來回波動,整體處於震蕩區間中部。成交量方面,當前交易量維持在相對均值水平,未見明顯放量跡象。MACD 指標上,快慢線仍在零軸下方黏合,柱狀圖紅綠交替但幅度有限,顯示市場動能仍較爲疲軟,短期內或將延續震蕩整理格局。【1】

- ETH —— ETH 價格在過去 24 小時內下跌 1.24%,目前報 1,752.39 USDT。從圖表來看,ETH 維持在 1,731 至 1,816 USDT 區間內震蕩整理,價格整體圍繞 5 日、10 日與 30 日均線附近反復波動,短期內未形成有效突破。成交量方面,交易活躍度較低,放量配合不足,顯示資金觀望情緒仍在延續。MACD 指標方面,快慢線黏合於零軸下方,柱狀圖紅綠交替、波動幅度減弱,短線動能趨緩,整體維持震蕩格局。【2】

- ETF —— 據 SoSoValue 數據顯示,4 月 24 日美國比特幣現貨 ETF 總淨流入 4.42 億美元【3】,美國以太坊現貨 ETF 總淨流入 6,349 萬美元。數據截至 4 月 25 日 10:00 AM (UTC+8)。【4】

- 山寨幣 —— Bitcoin Sidechains、AI Agent Launchpad、AI Agents 等板塊分別漲 +9.8%、+6.2%、+4.0%。【5】

- 美股三⼤指數 —— 4 月 24 日標普 500 指數漲 2.03%,道瓊斯指數漲 1.23%,納斯達克指數漲 2.74%。【6】

- 現貨黃金 —— 現貨黃金價格至 3,356.73 美元 / 盎司,日內漲幅 0.37%。數據截至 4 月 25 日 10:00 AM (UTC+8)。【7】

- 恐懼與貪婪指數 —— 恐懼與貪婪指數 60,市場處於貪婪狀態。【8】

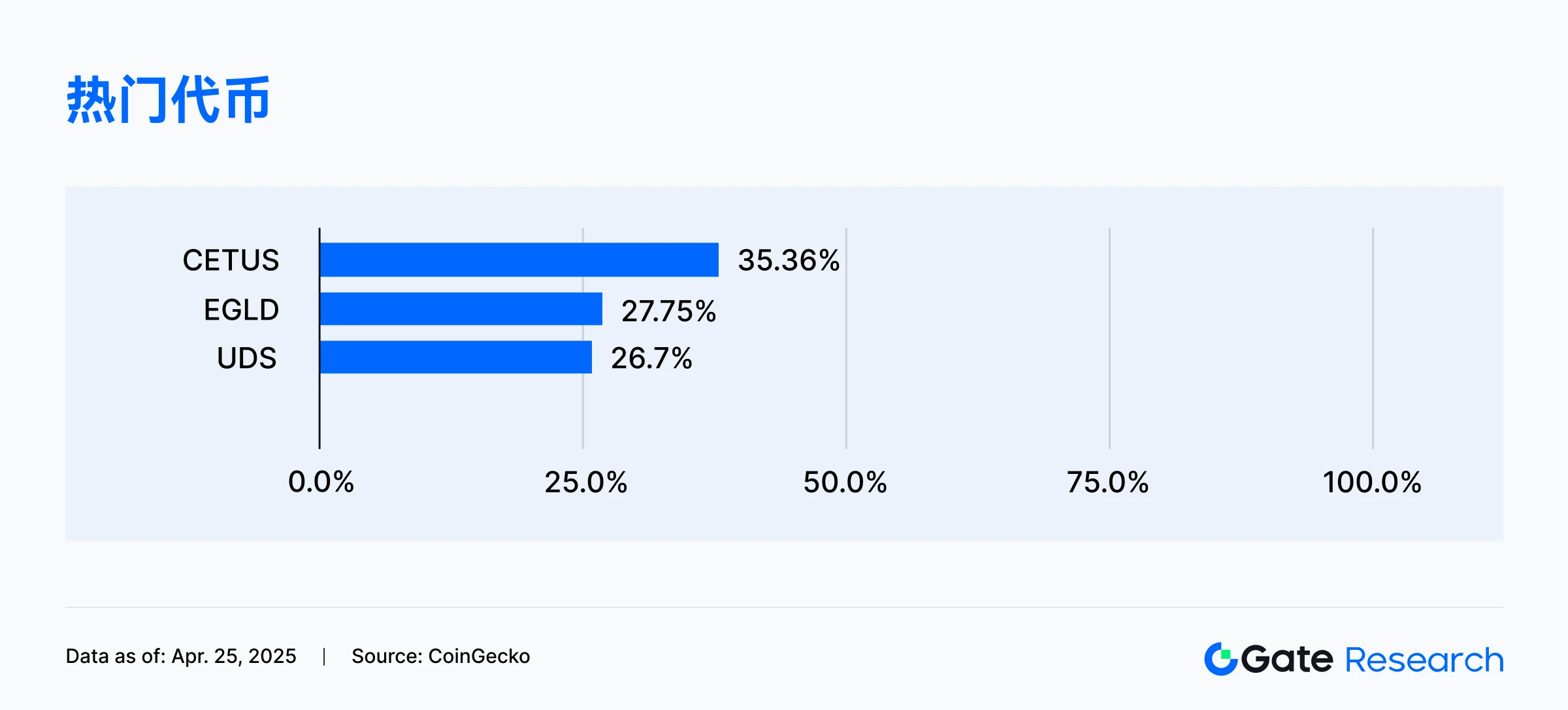

熱門代幣

根據 Gate.io 行情數據【9】,結合近 24 小時交易量和價格表現,熱門山寨幣如下:

CETUS (Cetus Protocol) —— 單日漲幅約 35.36%,流通市值爲 1.39 億美元。

Cetus Protocol 是一個建立於 Sui 與 Aptos 區塊鏈上的去中心化交易所(DEX)與集中流動性協議。平台採用集中流動性市場制造者(CLMM)模型,允許流動性提供者在特定價格區間配置資產,以實現更高的資本效率。Cetus 專注於提升交易體驗與流動性效率,是 Sui 和 Aptos 生態中核心的基礎設施之一。其代幣經濟包含治理與效用代幣 CETUS,以及用於質押與治理投票的 xCETUS。

CETUS 本輪漲原因主要受到協議集成與生態聯動的帶動。近期,Cetus 與 Nemo Protocol 完成 Vault LP 集成,解鎖更多鏈上收益場景,包括 LST 獎勵與收益交易功能。同時,Cetus 持續強化與 Sui Network 的生態聯動,借助 Sui 在用戶增長與資金流入方面的強勢表現,進一步提升了平台曝光度與代幣市場關注。市場普遍看好其在 Sui 生態中的長期價值,帶動了本輪價格漲。【10】

EGLD (Multiversx) —— 單日漲幅約 27.75%,流通市值爲 5.29 億美元。

MultiversX 是一個採用分片技術、專注於高擴展性和低交易成本的區塊鏈平台。平台支持每秒高達 100,000 筆交易,定位於爲去中心化金融(DeFi)、現實世界資產(RWA)和元宇宙應用提供底層基礎設施。其原生代幣 EGLD 用於交易支付、網路質押和治理機制,是生態系統運轉的核心資產。

EGLD 本輪漲原因主要受到技術升級與生態整合的多重利好推動。近期,Andromeda 升級進入關鍵階段,承諾將區塊最終化時間縮短至 600 毫秒,吸引關注區塊鏈性能的投資者。同時,PulsarMoneyApp 宣布接入 MultiversX 生態系統,爲支付和用戶增長帶來新入口,以上利好消息共同推動了幣價的漲。【11】

UDS (Undeads Games) —— 單日漲幅約爲 26.7%,流通市值爲 5,868 萬美元。

Undeads Games 是一款於 2022 年推出的多人在線角色扮演遊戲,設定在後啓示錄元宇宙,支持通過遊戲賺取加密貨幣的機制。該項目採用雙代幣模型:UDS 爲治理和交易主幣,UGOLD 爲遊戲內動態代幣。遊戲支持網頁、桌面與移動平台,主遊戲已於 2024 年第二季度上線 Steam。

UDS 本輪漲主要受到其遊戲測試進展與社區情緒的雙重推動。根據官方發布的第 3 輪測試版進展情況,遊戲在匹配系統、地圖性能以及視覺特效等方面進行了多項重大優化,特別是在戰鬥體驗流暢度與界面視覺表現上的顯著提升,引發了玩家與社區的高度關注。同時,開發團隊頻繁與社區互動並回應反饋,進一步提升了市場對遊戲品質與長期發展的信心。結合 Web3 遊戲板塊整體熱度的回升,疊加平台對 UDS 代幣經濟模型的持續完善,使得市場對項目未來價值的預期不斷增強,推動 UDS 在短時間內實現了顯著漲。【12】

亮點數據

Solana 穩定幣市值創下 128.85 億美元新高,USDC 佔比近八成

Solana 區塊鏈上的穩定幣市值於 2025 年 4 月 25 日首次突破 128.85 億美元,刷新歷史紀錄。該鏈因其高速處理能力與低交易成本,日益成爲穩定幣發行與交易的熱門平台,尤其在 DeFi 和支付場景中吸引大量用戶。USDC 是增長的主要驅動力,佔據近 77% 的市值份額,Circle 今年已在 Solana 上鑄造超 60 億美元的 USDC,顯示出強勁的機構和開發者支持。

今年初,Solana 曾因模因幣熱潮(如 TRUMP 與 MELANIA)引發短期交易量飆升,推動穩定幣需求激增。盡管熱度有所回落,但穩定幣市值保持上行,反映出 Solana 的生態增長正從投機走向更穩定的實際應用,包括交易、借貸和支付等領域。

穩定幣的廣泛使用也爲 Solana 的 DeFi 生態擴展提供了流動性基礎。雖然總鎖倉量(TVL)從年初高點有所波動,但穩定幣活躍度的持續提升,正在增強 Solana 在以太坊之外的鏈上金融地位,並釋放其在 RWA 與支付整合中的平台潛力。【13】

SUI 市值超越 LINK,ETF 熱點與 Meme 幣助推上行

2025 年 4 月 25 日,SUI 的市值首次超過 Chainlink(LINK),以約 108.3 億美元位居全球第 13 大加密資產,LINK 則退居第 14,市值約爲 99.3 億美元。數據顯示,SUI 當前流通供應量爲 32.5 億枚,單價約爲 3.33 美元;LINK 的供應量爲 6.57 億枚,單價約爲 15.11 美元。

此次 SUI 市值躍升與多個因素相關,包括 CBOE 於 4 月初提交的 SUI 現貨 ETF 申請,以及 Sui 網路上 Meme 幣生態(如 MUI、LOFI、BLUB、DEEP)的爆發式增長。這些因素共同帶動了 SUI 在過去 7 天內漲 54%,而同期 LINK 僅漲 20.6%。ETF 與熱點項目帶來的資金與用戶湧入,使 SUI 成爲短期資金關注的焦點。

鏈上數據也印證了這輪漲背後的活躍度提升。據 DefiLlama 數據,截至 4 月 24 日,Sui 的總鎖倉量(TVL)達到 7.45 億美元,較一周前的約 5.68 億美元增長超過 31%。TVL 增長顯示網路實際使用率提升,爲市值漲提供了基本面支撐。隨着 ETF 申請進程推進及 Meme 幣熱度未退,SUI 的鏈上指標和市場表現仍將持續受到關注。【14】

Uniswap 協議的總交易量突破新高,逼近 3 萬億大關

據 Dune 數據顯示,截至 2025 年 4 月,Uniswap 協議的累計交易總額已突破 2.94 萬億美元。從圖表可見,自 2020 年以來,Uniswap 的交易量呈現出持續上升趨勢,尤其是在 2021 年之後加速攀升,充分體現了其在去中心化交易領域中的領先地位與強勁吸引力。

Uniswap 是基於以太坊的去中心化交易協議,採用自動化做市商(AMM)模型,允許用戶在無需中心化中介的情況下交換代幣。其交易量增長得益於多鏈擴展(如 Polygon、Arbitrum、Optimism)、Uniswap V3 的推出以及 Layer 解決方案帶來的成本降低和交易速度提升。自 2022 年 5 月累計交易量突破 1 萬億美元以來,年均增長率約爲 43%,展現出強勁的市場吸引力。

此外,Meme 幣熱潮、穩定幣鑄造增長以及鏈上原生資產的興起等因素,也持續提升鏈上交易活躍度,爲 Uniswap 提供了源源不斷的交易動能,推動其總交易量不斷逼近 3 萬億美元大關。【15】

熱點點評

聯準會撤銷對銀行加密業務的監管指導,釋放監管松動信號

聯準會於 2025 年 4 月 24 日宣布正式撤銷此前針對銀行開展加密資產與美元穩定幣相關活動的監管指導信函及聯合聲明,標志着美國銀行體系對加密業務的監管態度出現重大轉變。這項決定旨在使監管預期與行業風險演變保持一致,同時爲銀行體系中的技術創新提供更大空間。

此次撤銷涉及 2022 年發布的監管信函,該信函曾要求州成員銀行在開展或計劃開展加密資產業務前主動通知監管機構。此後,聯準會將不再要求提前通知,而是通過常規審查流程進行監督。同時也撤銷了 2023 年針對美元穩定幣活動所設的“無異議”監管流程,並與聯邦存款保險公司(FDIC)和貨幣監理署(OCC)一道,共同退出兩項 2023 年針對加密資產風險和流動性風險的聯合聲明。

這項政策調整釋放出監管態度轉向“寬容但不放任”的信號。盡管撤銷通知機制和聯合聲明看似“松綁”,但監管核心仍回歸到常規審查流程,意味着監管者仍希望在不直接限制創新的前提下,維持對金融穩定的掌控。此舉既可能爲銀行探索合規的加密業務留出更大靈活性,也反映出監管機構在壓力環境中逐步調整監管工具與節奏的現實考量。【16】

Sui 推出數字版萬事達卡,支持歐洲用戶使用加密支付

Sui 基金會宣布與金融平台 xMoney 和加密超級應用 xPortal 建立戰略合作夥伴關係,推出面向歐洲用戶的虛擬 Mastercard。xPortal 將 Sui 鏈集成至其擁有 250 萬用戶的錢包應用中,用戶可在應用內體驗定制的 Sui 錢包,並將虛擬 Mastercard 添加至 Apple Pay 和 Google Pay,實現加密貨幣在現實世界的無縫支付。預計今年晚些時候還將推出實體卡片。

Sui 負責提供速度、吞吐量和無縫的用戶體驗。xMoney 提供金融基礎設施,包括支付處理、卡片發行和合規許可,確保該服務在歐盟等受監管市場的順利運行。xPortal 則通過其用戶友好的界面,使用戶能夠在一個平台上購買、交換、質押和消費加密貨幣,保持了自我托管的安全性和所有權優勢。Sui 基金會常務董事 Christian Thompson 表示,這一創新產品顯著提升了 Sui 生態系統對日常消費者的可及性。

Sui 成爲少數幾個通過完全合規平台支持無摩擦現實世界支付和金融服務的 Layer 1 區塊鏈之一。用戶現在可以在超過 20,000 家商戶使用 SUI 代幣進行支付,進一步推動了加密貨幣的主流採用。未來,Sui 計劃將此服務擴展至美國,並在即將舉行的 Sui Basecamp 活動中公布更多企業級服務和產品發布,持續推動數字經濟的創新和發展。 【17】

Securitize 聯手 Mantle 推出機構加密基金,瞄準“加密版 S&P 500”

4 月 24 日,Securitize 宣布與 DeFi 協議 Mantle 合作推出名爲 Mantle Index Four(MI4)的機構加密基金,旨在爲機構投資者提供涵蓋比特幣、以太坊、Solana 及穩定幣的多元化加密資產敞口,同時通過鏈上質押代幣獲取收益。基金包含如 Mantle 的 mETH、Bybit 的 bbSOL 和 Ethena 的 USDe 等資產,意在借助流動性質押機制提升整體回報。

該基金採用市值加權設計,定位爲“加密市場的 S&P 500”,爲機構提供類似傳統指數基金的結構化收益選擇。Mantle 表示,mETH 當前年化收益率約爲 3.78%,平台 TVL 超過 6.8 億美元,反映出對鏈上收益產品的市場需求持續上升。

Securitize 作爲主流的現實世界資產(RWA)代幣化平台,當前市場份額約達 71%,其與 BlackRock 合作的 BUILD 基金已管理超 25 億美元資產。此次推出 MI4 基金,正值機構和零售投資者紛紛尋求加密資產對沖宏觀不確定性的背景下,也突顯出鏈上資產配置模式正在快速邁向主流。【18】

Gate.io 糖果空投平台 CandyDrop 上線

Gate.io 推出了全新的糖果空投平台 CandyDrop。該平台採用任務驅動機制,旨在降低用戶獲取加密貨幣的門檻,並通過用戶完成如交易、充值、邀請好友等任務來賺取“糖果”積分。這些積分最終將用於兌換 Gate.io 篩選出的優質項目代幣空投,爲用戶提供了一種便捷、高效的免費獲取代幣的方式。CandyDrop 支持通過 Web 端和 App 端輕鬆參與,用戶完成的任務越多,獲得的糖果越多,從而能在活動結束後分到更多的項目代幣。目前,CandyDrop 的首期活動已經啓動,用戶參與指定任務即可分享 HYPER 代幣獎池。【19】

CandyDrop 採用任務驅動的空投模式,將用戶的活躍度與代幣激勵緊密相連。這爲那些希望通過空投進行社區建設和代幣分發的優質項目,提供了一個高效且目標明確的渠道。同時,Gate.io 平台對合作項目進行嚴格篩選,這有助於提升用戶所能獲取資產的質量和可靠性,使其區別於市場上一些低質量的空投活動。因此,對於用戶而言,CandyDrop 提供了一個相對簡便且風險較低的途徑來接觸和獲取新的項目代幣。

融資訊息

據 RootData 數據,過去 24 小時共有 2 個項目公開宣布獲得融資,涉及基礎設施和去中心化金融(DeFi)等領域,融資金額爲 625 萬美元,以下是融資項目具體情況:【20】

Inco Network —— 完成了 500 萬美元的戰略融資,由 a16z crypto CSX 領投,Coinbase Ventures、1kx、Orange DAO、South Park Commons 和 Script Capital 等參投。Inco Network 是 EVM 兼容的 Layer-1,利用完全同態加密 (FHE) 來實現可組合和可操作的隱私狀態。 其 fhEVM(FHE + EVM)使得編寫隱私智能合約並在加密數據之上執行計算而無需解密成爲可能。

此次融資旨在進一步推動項目在解決區塊鏈保密性問題上的技術研發與產品落地,特別是在加強數據隱私保護、提升交易匿名性以及構建更加安全可信的去中心化應用基礎設施方面取得實質性進展。【21】

Catalysis —— 完成了 125 萬美元的 Pre 種子輪融資,由 Hashed Emergent 領投,Presto Labs、Spaceship DAO、Funfair Ventures、Cosmostation 和 Crypto Times 等參投。Catalysis 是一家去中心化服務基礎設施初創公司,旨在統一多個再質押協議的經濟安全性。

此次融資將用於開發首個“安全抽象層”,簡化開發者和節點運營商部署共享安全服務的流程。該平台已與 EigenLayer、Symbiotic 和 Kernel DAO 等再質押協議集成,計劃於 2025 年第二季度上線公開測試網。【22】

空投機會

Initia

Initia 是一個專注於構建統一跨鏈生態系統的區塊鏈平台,結合 Layer 1 主鏈與多種交織型 Rollup 網路,允許開發者部署自定義的應用鏈(Appchains),實現高性能且具備互操作性的多鏈應用環境。其架構採用 Cosmos SDK 構建,並支持多種虛擬機(如 EVM、MoveVM、WasmVM),目標是爲 dApp、DeFi、遊戲等提供高度可擴展與模塊化的基礎設施。項目由前 Terraform Labs 成員主導,強調開發者友好性、經濟一致性與用戶體驗。

目前,Initia 正進行原生代幣 INIT 的空投活動,本次空投總量爲 5,000 萬枚 INIT,佔總代幣供應的 5%,發放對象包括測試網參與者、生態合作協議用戶與社交平台活躍用戶。【23】

參與方式:

- 訪問空投頁面:前往 Initia 官方頁面,連接錢包自動檢查領取資格。

- 領取時間:主網上線後 30 天內可領取,預計爲 2025 年 4 月 24 日至 5 月 24 日,逾期將無法申領。

- 空投分配比例:

- 測試網參與者:90%(約 4,470 萬 INIT)

- 合作協議用戶:4.5%(如 LayerZero、IBC 等)

- 社交活躍用戶:6%(Discord、Telegram、X)

提示:

空投計劃和參與方式可能會隨時更新,建議用戶關注 Initia 的官方渠道以獲取最新信息。同時,用戶應該謹慎參與,注意風險,並在參與前做好充分的研究。Gate.io 不保證後續後續空投獎勵發放。

參考資料:

- Gate.io, https://www.gate.io/trade/BTC_USDT

- Gate.io, https://www.gate.io/trade/ETH_USDT

- SoSoValue, https://sosovalue.xyz/assets/etf/us-btc-spot

- SoSoValue, https://sosovalue.xyz/assets/etf/us-eth-spot

- CoinGecko, https://www.coingecko.com/categories

- Investing, https://investing.com/indices/usa-indices

- Investing, https://investing.com/currencies/xau-usd

- Gate.io, https://www.gate.io/bigdata

- Gate.io, https://www.gate.io/price

- X, https://x.com/CetusProtocol/status/1914997568637136951

- X, https://x.com/MultiversX/status/1915074161619148880

- X, https://x.com/Undeadscom/status/1914967296306815170

- DefiLlama, https://defillama.com/stablecoins/Solana

- DefiLlama, https://defillama.com/chain/sui

- Dune, https://dune.com/mud2monarch/countdown-to-three-trillion-united-states-dollars

- Federalreserve, https://www.federalreserve.gov/newsevents/pressreleases/bcreg20250424a.htm

- SUI , https://blog.sui.io/xmoney-xportal-wallet-mastercard/

- Cointelegraph, https://cointelegraph.com/news/securitize-mantle-launch-institutional-crypto-fund

- Gate.io, https://www.gate.io/candy-drop

- Rootdata, https://www.rootdata.com/Fundraising

- Rootdata, https://www.rootdata.com/Projects/detail/Inco%20Network?k=OTc5Ng%3D%3D

- Rootdata, https://www.rootdata.com/Projects/detail/Catalysis?k=MTczMTM%3D

- Initia, airdrop.initia.xyz

Gate 研究院

Gate 研究院是一個全面的區塊鏈和加密貨幣研究平台,爲讀者提供深度內容,包括技術分析、熱點洞察、市場回顧、行業研究、趨勢預測和宏觀經濟政策分析。

免責聲明

加密貨幣市場投資涉及高風險,建議用戶在做出任何投資決定之前進行獨立研究並充分了解所購買資產和產品的性質。 Gate.io 不對此類投資決策造成的任何損失或損害承擔責任。